The 2020s have been coined “The Solar Decade” and for good reason as solar enters an exponential growth phase. This article spotlights five solar trends that you need to know about if you’re involved in buying and selling solar equipment. Get ready for big business. It’s coming – fast.

Trend 1: Module prices are higher in the U.S. than in European countries and Australia.

According to Wood Mackenzie, prices of solar modules in the U.S. are 40-50% higher than in European countries and Australia. The higher prices are primarily caused by supply shortage and tariffs.

What does this mean for the industry?

Higher module prices in the U.S. stress the importance of providing buyers with alternative procurement options and solutions that reduce soft costs.

What does this mean for solar companies?

Online exchanges like EnergyBin bring together PV professionals in one network to combine resources, promote transparency and form collaborative partnerships that aim to reduce costs. As an example, contractors use EnergyBin to request multiple quotes to prove to customers that they are willing to go the extra mile to find the best deals for them.

Solar companies are getting wise to equipment brokering as well. By reselling material you no longer need, you create an additional revenue source. Resale supports the industry’s goal to make solar a mainstream commodity, especially when material can be immediately rolled into present-day projects at prices below next-generation technology.

What does this mean for solar equipment brokers?

Solar equipment brokers play a key role in redistributing material, whether it be overstock from manufacturers or left-over parts from contractors. Your opportunity to make money lies in resale. The reality is that supply shortage primarily relates to new technology on back-order. But the market is full of new and used 200W+ and 300W+ modules that are resold in the secondary market.

Various soft costs decrease when companies work together to redistribute material. For example, a buyer and seller located in the same geographic region can easily reduce transportation logistics and warehousing costs by transacting with one another. By selling excess material, the seller no longer needs to pay to store it. By buying from the nearby seller, the buyer avoids international shipping costs.

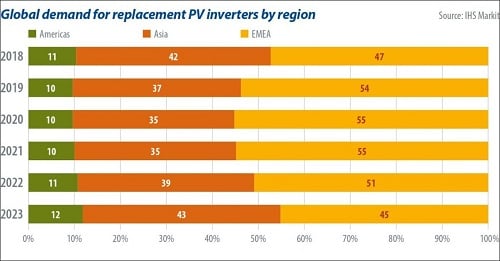

Trend 2: Global demand for replacement inverters is expected to rise.

In 2020, global demand for replacement inverters is expected to increase by 40% according to IHS Markit.

What does this mean for the industry?

By the end of the year, we’ll see an aging inverter capacity of 8.7 GW in need of replacement. The vast majority of this demand (70%) will span from Germany, Italy and Spain. Demand will continue to rise over the decade due to aging models that either underperform or malfunction.

What does this mean for solar companies?

Solar companies with aging systems should prepare for maintenance issues, such as failing components. Talk to your customers to understand their expectations. IHS Markit notes that exact match models to replace old inverters is the most commonly preferred solution taken by customers.

If you know that components in use are discontinued, keep an eye out for replacement parts in the secondary market. One contractor was recently successful in locating a pallet of discontinued inverters on EnergyBin. He selected this model for his customers’ off-grid systems years ago. He purchased the pallet to serve his customers’ needs over the next several years while he works with them to plan for future technology upgrades.

What does this mean for solar equipment brokers?

Replacement demand leads to new opportunities for solar equipment brokers to make money. Those of you who excel at hunting down hard-to-find replacement models will forge new business relationships with solar companies in need. Tapping into your global networks gives you an advantage to locate parts that have long since exited the primary market.

But with rapid technology advancement and market consolidation over the last twenty years, some models will unfortunately be impossible to find. In this case, repair and fabrication specialists may find new opportunities with increased replacement demand.

In situations where inverters cannot be replaced and the cost to fabricate or repair outweighs the benefit, repowering with new technology may be the best option. Employ your brokering skills to work with system owners. Gather quotes from multiple suppliers. Help to negotiate best pricing for a new system. Take assessment of decommissioned material to determine what parts have reuse/resale value and what equipment is ready to recycle.

By offering a smooth transition from old to new, you put the customer at ease regarding cost and risk. Plus, you have first dibs on material that may have a profitable resale value.

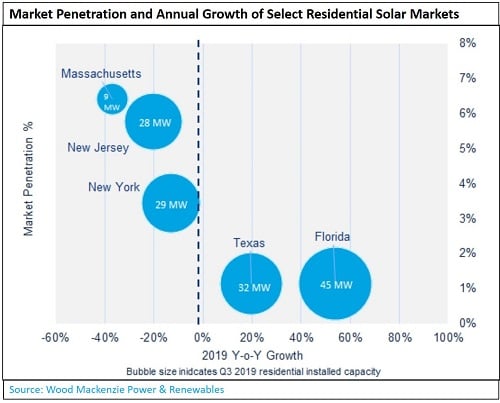

Trend 3: Florida, Texas and Nevada are the big three emerging markets for residential solar in the United States.

All three states get a lot of sun, are largely populated and are ready to boom in solar this decade.

What does this mean for the industry?

According to Greentech Media, three factors contribute to their residential solar demand. First, growth is ramping up in absence of significant state-wide incentive programs. Second, electricity rates are lower in all three states, which forces solar to be more cost competitive. Third, market penetration is low. For example, residential installed capacity in Florida (45 MW) and Texas (32 MW) amounts to just 1% of the potential market.

What does this mean for solar companies?

These emerging markets prove that demand can explode in absence of prominent incentive programs. But solar companies, especially residential installers, should take extra measures to ensure services are competitively priced (and can pass as a mainstream commodity). Don’t assume one quote from one supplier is enough to win a customer’s business.

Be prepared to offer multiple quotes at varying prices and options. Take a holistic approach that covers a full range of customer “smart home” expectations as discussed in the next section, as well as continuing customer service all the way through your customer’s system end-of-life.

What does this mean for solar equipment brokers?

For brokers, these markets will create opportunities for you to act as procurement facilitators for both contractors and homeowners. With respect to their budgets, homeowners may appreciate more equipment options at varying prices. Selecting the top efficiency panel may not be as important if going with a lower efficiency, lower wattage panel meets their energy needs and saves them money. Check available product on EnergyBin.

In addition, be on the look-out in these markets for excess material left over from projects. Get to know local contractors in the area. Plant the seed early on that you’re the one to call when they have miscellaneous material. Be ready to offer a cash buyout for material with resale value.

For more advice on dealing with excess material, read what EnergyBin experts have to say.

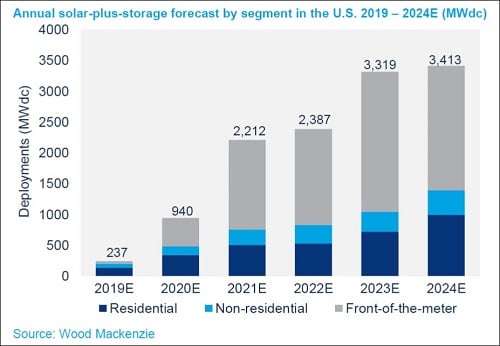

Trend 4: The “Solar Plus” decade is here.

Wood Mackenzie reports that stand-alone solar will take a back seat to solar systems coupled with other purposes, such as floatovoltaics, agrivoltaics, aquavoltaics, building-integrated photovoltaics, and storage.

What does this mean for the industry?

Due to the increasing challenge of finding suitable land at an affordable cost, developers and utilities are looking at new ways to pair solar with other uses.

Regarding the global storage market, growth will reach more than 15 GW in 2024, mostly driven by large commercial and utility-scale projects. The uptick in distributed segments is primarily due to rate design changes that devalue solar export and resiliency needs of customers.

What does this mean for solar companies?

Solar plus solutions lead to new product innovations for manufacturers to pursue. For example, Wood Mackenzie notes floating trackers as a new niche product for floatovoltaics.

Those solar companies working in the storage sector need to continually seek ways to reduce costs as demand rises. One way to do so is through the use of end-of-life EV batteries that can be placed in static residential and utility-scale energy storage systems.

In the residential market, some inverter companies are launching new products that combine the internet-of-things (IoT), energy optimization, storage, and other capabilities to offer customers an “all-in-one” smart home system. When you are in tune with customer needs, you gain a competitive advantage that could span across multiple industries.

What does this mean for solar equipment brokers?

With new products, heightened competition and rapid growth, brokers have the opportunity to act as sales representatives to move products out into the marketplace. More product options lead to more opportunities to sell and make money.

You may also find a niche by partnering with companies who specialize in IoT products or other services that bring value to your customer experience. Brainstorm ways you can create customized packages that respond to the solar plus demand.

Trend 5: Solar repowering projects will ramp up this decade.

More than 67 GWdc of global solar capacity will reach 20 years’ maturity in the 2020s, reports Greentech Media.

_Source_Wood%20Mackenzie.jpg?width=500&name=Potential%20repowering%20market%20by%20year%20for%2020-year%20old%20systems%2c%202020-2030%20(MWdc)_Source_Wood%20Mackenzie.jpg)

What does this mean for the industry?

Repowering is all about upgrading technology. Particularly for systems that have expired warranties or are not meeting performance expectations, repowering appears to be a viable option. Most systems marked for potential revamps are located in Europe.

What does this mean for solar companies?

Developers and EPCs can proactively approach customers with aging systems to begin the repowering dialogue. Know what markets discredit aging systems and what markets require modules be recycle-ready when decommissioned. As Greentech Media notes, projects in the U.K. and Germany that reach 20 years’ of age lose their subsidy support. France and Italy have limits for increasing capacity to subsidy-supported systems.

Solar companies can also keep customers informed when components are discontinued, as well as educate them about newer technology. Be sensitive to your customers’ perspectives. Whether they are a utility company or a homeowner, repowering a system before its end-of-life projection may be a challenging and financially burdensome decision to make.

For system owners who are ready to move forward with repowering, new opportunities open by incorporating the latest technology, such as bifacial modules and batteries. Greentech Media sees storage as a way to prepare systems for life beyond subsidies.

What does this mean for solar equipment brokers?

Brokers can also begin talking to customers about repowering options. Point out that, depending on the quality of decommissioned material, some components may have resale value. Offer your services to conduct a materials assessment.

You may also create value in offering recycling center delivery of decommissioned material. Such a service takes away the burden of your customers having to deal with the old material.

Work with customers to research upgrade options. If you’re lacking tech knowledge, partner with a PV technician. Many certified technicians work as independent consultants who offer design and permitting services. Partnering with a technology expert lets you focus on what you do best – finding the best priced equipment to satisfy your customer’s needs.

Solar Trends + Action = Results

Whatever role your company plays in the solar industry, these trends challenge you to take action. How can your company integrate these trends into your strategic goals? What needs to change internally to position your company to pursue opportunities spanning from these trends? What new ways can you leverage your strengths to reap results?

Taking an honest assessment of your business today and where you’d like to be ten years from now is the starting point. You know where the industry is headed. Don’t let complacency or aversion to change prevent you from taking these trends to heart. Craft your vision, take action, and you’ll achieve results.

You May Also Like:

Secondary Solar Market Myths Debunked

Secondary Solar Market Myths Debunked