Author's Note: Since the publication of this article in 2019, both Hollis Miles and Stephanie Oropeza have left their positions noted below. However, all three expert companies - Kinect Solar, Ontility, and Surplus Solar Products - are active EnergyBin members. For updated buy-back programs and other value-added services, please inquire directly with these companies.

It's a common frustration among solar companies when unplanned excess stock is incurred. From solar panels to inverters, mounting to racking, the pile-up could cost your business thousands of dollars.

When you end up with excess stock, your best option is to sell it in a timely manner to recoup your investment and minimize costs. But knowing how and where to sell isn’t necessarily common knowledge.

To address the issue of excess stock, we turned to the experts – solar equipment brokers – for their advice. These brokers are keen at finding new buyers for excess stock, thus giving such inventory new life. They work hand-in-hand with you to get the job done.

In this article, we cover the reasons why excess stock occurs and the cost associated with holding it, how to position it online for sale, and selling tips from the experts.

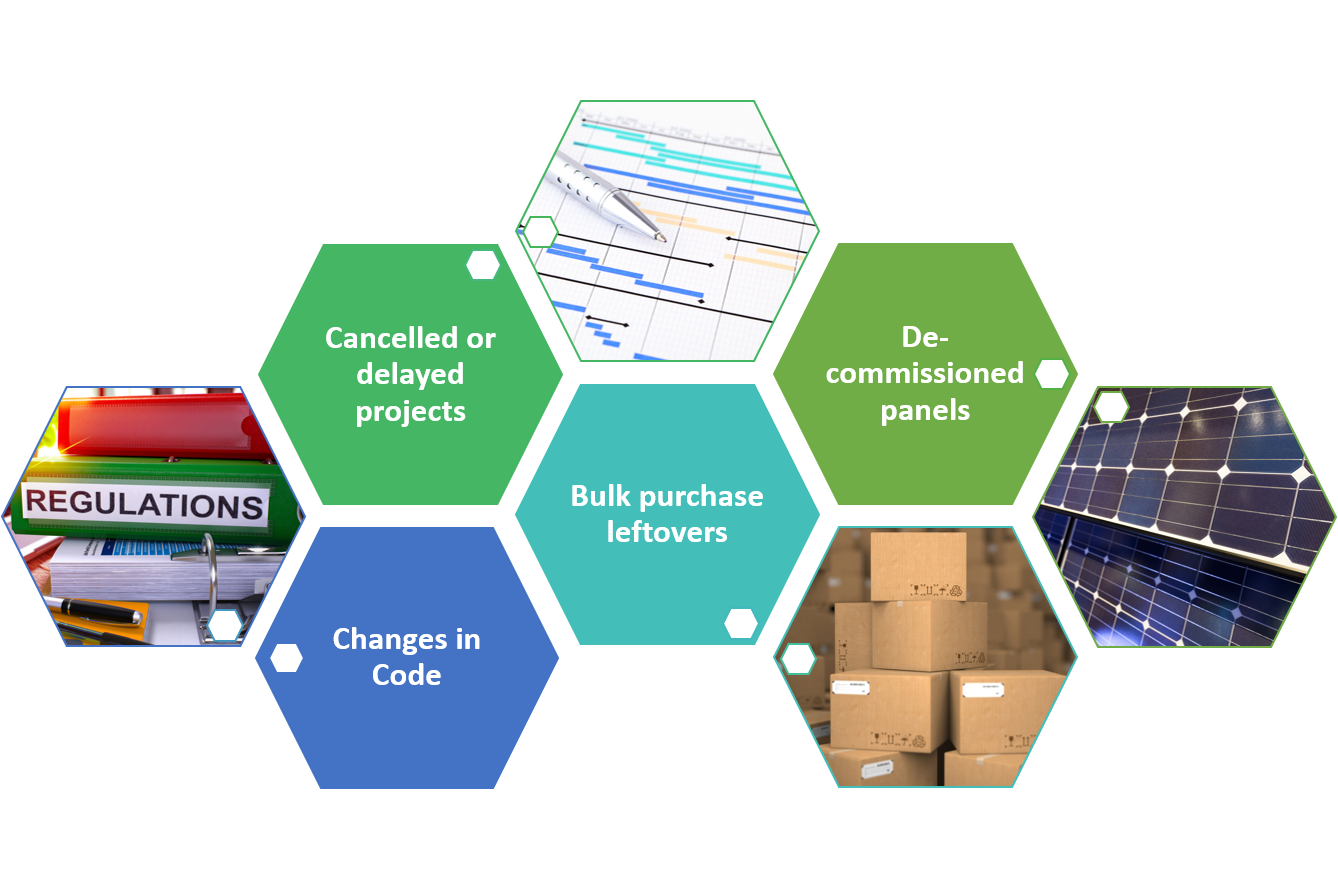

Reasons why excess stock occurs

There are many reasons why you may get stuck with unwanted excess stock. Although demand for solar has never been better, unforeseen situations happen. Let’s take a look at the main reasons for excess stock.

Cancelled or delayed projects

From time to time, a project could be cancelled or delayed. For example, many solar companies went through unexpected project cancellations and delays in 2018 following Section 201 tariffs taking effect. This new legislation impacted projects of all sizes – from residential to utility-scale. According to SEIA and Wood Mackenzie Power & Renewables, an estimated $8 billion of utility-scale projects were canceled or postponed.

Changes in code

Another reason you may incur excess stock is from changes in local or regional code standards. Two examples of code changes are ISO-New England’s inverter source requirements and California’s Rule 21. Although these changes deem your non-compliant inverters obsolete in said markets, you can find new buyers to sell this product to in other regions throughout the U.S. and abroad.

Bulk purchase leftovers

Perhaps you have excess stock from making a bulk purchase. The cost savings of ordering in bulk justified purchasing a greater quantity than your project required. You think to yourself, “I’ll hold onto the extras to use as replacement parts or roll into another project down the road.” You may very well be able to do so. However, reselling the excess frees up cash and warehouse space. Holding the stock may cost your business more in the long-run, as discussed in the next section of this article.

Decommissioned panels

If your company decommissions an existing array, you may end up with used panels that are still functional. In some cases, owners decide to upgrade technology. In other cases, roof repairs are needed, and the owner chooses not to reinstall the array. Instead of sending this stock to the scrap yard, consider reselling the product online. Buyers looking for replacement parts, bargain shoppers and DYI homeowners are part of what is known as the secondary market.

The cost of holding excess stock

In an industry where savvy companies strive to maintain healthy inventory turnover rates, unwanted excess stock can complicate logistics and increase expenses.

Holding onto excess stock increases your inventory costs, such as warehouse storage, internal movement (labor) and any interest owed on borrowed money. This cost also includes insurance, utilities and security. Depreciation and the risk of obsolescence are also factors of holding costs. As the name implies, the longer an item is held, the higher the holding costs will be.

In addition, there is an opportunity cost incurred when holding older stock. It prevents you from purchasing newer equipment that may sell faster.

To calculate your total holding cost, add all of the expenses discussed and any other inventory costs specific to your company. Multiply by twelve months to get the annual total. To view the cost as a percentage of your total inventory costs, divide the amount into what you paid for inventory.

For example, say you have a quantity of 830 Tier 1 panels that are each 290W. You purchased this lot with cash for a 24kW project. Before the project could be constructed, it was cancelled, and you were left with these new, never-been-opened panels. You think to yourself, “I’ll just hold onto them and roll them into a new project in the near future.” You move them into storage and redirect your attention to the next projects in your cue.

Time goes by. Panel wattage jumps into the 300-watt range. And your customers start demanding the latest technology. A year goes by before you realize the 290W lot is still sitting dormant in your warehouse. When you calculate the holding cost of this lot, you’re surprised to learn it’s costing you around $16,000 per year to carry the stock. You paid $156,455 or $0.65 PPW for the lot. The holding cost is 10.2% of your inventory cost. It would be much higher if you had purchased on credit.

Although the holding cost varies from one company to the next, it is important to keep an eye on. Larger companies with more cash-on-hand and ample storage space will incur lower holding costs. But as the above example illustrates, no solar company is immune to rapidly changing technology.

Selling excess stock online

As illustrated, holding excess stock can be at a disadvantage to your business. Every day you sit on your inventory, you are giving up the opportunity to recoup costs.

“I’ve seen numerous instances where industry prices have fallen to the point where the company holding the inventory is taking a significant hit financially,” states Matt Creamer, President at Surplus Solar Products, a broker based in New York working with customers across the U.S. and around the world.

List inventory for sale online

You’ll want to start by listing your inventory online. Using a secure site like EnergyBin, the wholesale solar B2B exchange, exposes your product to a new group of pre-qualified buyers.

Listing the inventory online is easy to do once you have identified what site(s) to upload your inventory to. You can manage your listing anywhere Internet is available.

Be mindful in choosing what sites to list product on. No two are alike. They each have their own target audience. For instance, EnergyBin will connect you to a range of solar companies who manage residential, commercial and utility-scale projects and who are ready to deal.

Partner with a solar equipment broker

You may also find it valuable to partner with a solar equipment broker who can help with the sale of your excess stock.

On EnergyBin, you can connect with other members who specialize in brokering wholesale solar equipment. These equipment brokers offer a variety of services to ease the sales transaction.

For example, Kinect Solar, a broker focused on bringing high quality products to its global network, offers cash and consignment options to companies with excess stock.

“We can also protect the equipment owner by agreeing to sell the product outside of an established market or without ‘blasting’ the inventory, which could erode the value,” notes Hollis Miles, Chief Operating Officer.

Surplus Solar Products negotiates buy-outs of excess stock, where they strive to purchase everything all at once.

“Doing so alleviates [the owner from] trying to find multiple buyers for portions of the excess inventory,” remarks Matt. “We will work directly with the company to find common ground and price the material appropriately for both sides of the transaction.”

Ontility, a broker with twenty years’ experience in the solar industry, pays cash for nearly all purchased lots.

“If we assess it’s a good lot – valuable products – and worth our time, we will offer any services we can,” comments Stephanie Oropeza, Sales & Purchasing Administrator.

Benefits of working with a solar equipment broker

Brokers are keen when it comes to pricing and what’s in demand. Their networks span globally. They tend to have fast inventory turnover due to the nature of their business. They are constantly buying and selling equipment.

Brokers are usually willing to share their knowledge with others.

“Our team is made up of excess inventory market experts with nearly 100 combined years of experience in the solar industry,” notes Hollis at Kinect Solar. “We would be happy to share our market knowledge with other partners and welcome ways to expand our markets and relationships.”

Again, the ideal way to find brokers like Kinect Solar, Surplus Solar Products, and Ontility is to connect with them online. All three are members of EnergyBin, an online network of over 1,000 solar companies. EnergyBin’s parent company, Broker Exchange Network, has nearly twenty years’ experience working with over 15,000 brokers throughout 70 countries.

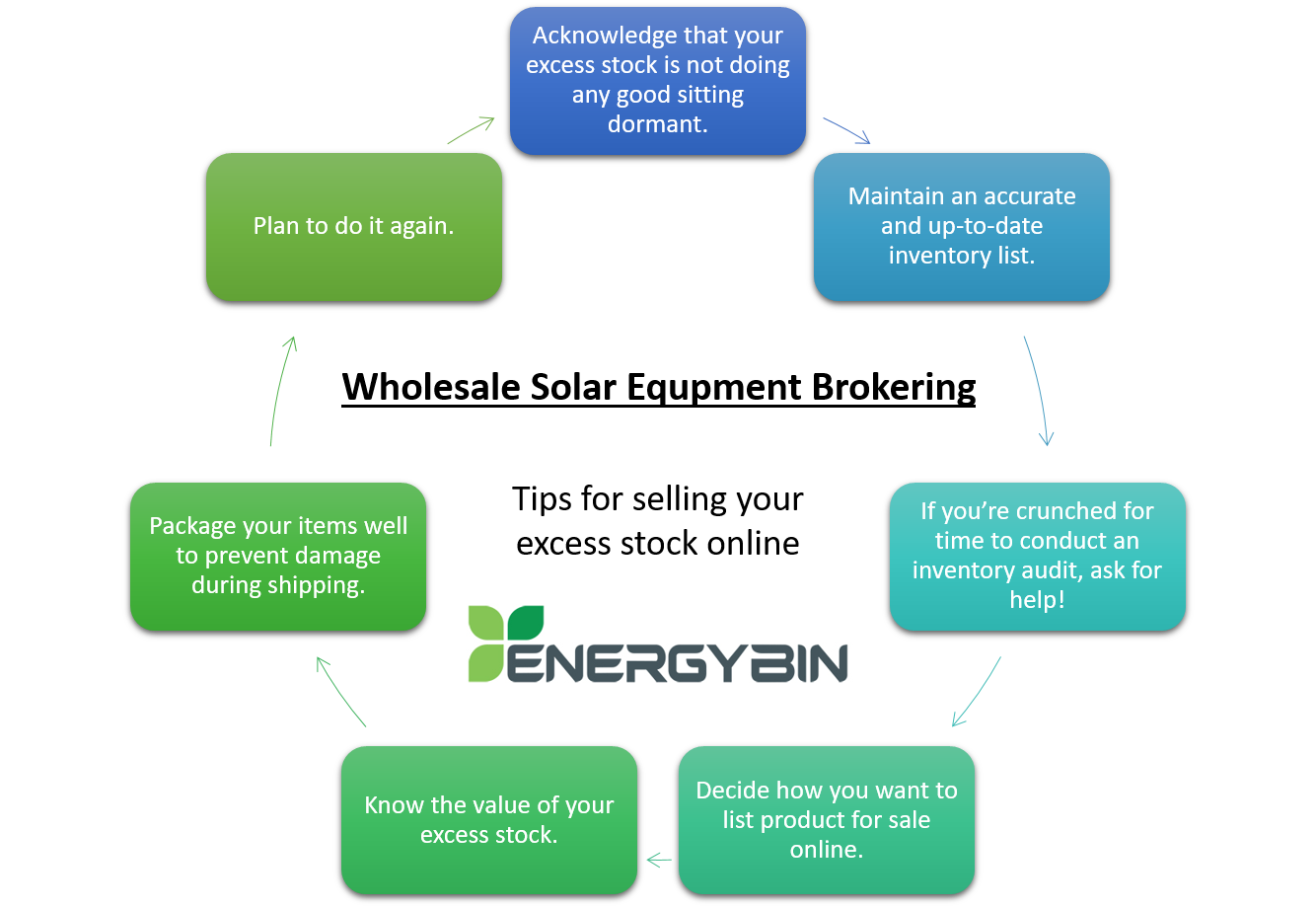

Tips for selling your excess stock online

Our experts at Kinect Solar, Surplus Solar Products and Ontility shared their advice for selling excess stock online. We’ve also added a few of our own tips from our experience in equipment brokering.

1. Acknowledge that your excess stock is not doing any good sitting dormant.

Oftentimes, our experts hear from solar companies, “I don’t want to sell my excess stock because I might need it in the future.”

This statement may bear some truth, but as discussed in this article, holding onto inventory can cost your company more down the road. The risks aren’t worth it. Plus, cash-on-hand tends to be a more valuable asset to have.

Stephanie at Ontility tells companies hesitant to let go of excess stock, “If you want cash today, we’ll take it off your hands. When you need product in the future, say even two weeks from now, we’ll talk about selling equipment to you at a reasonable price.”

If you doubt there is demand for excess stock, market conditions prove otherwise.

“No matter the product, there is almost always a potential buyer and value to be gained,” comments Hollis at Kinect Solar. “Even scrap, damaged or previously installed product can have value in certain markets. The key is to find the right customer.”

We would add to this sentiment that if you can’t find the right customer on your own, then partner with a broker who has a vast network of buyers.

2. Maintain an accurate and up-to-date inventory list.

Document as much information as possible, such as model numbers, frame/cell colors, quantities, etc.

“Doing so will expedite the sale of the material and build confidence for the purchaser,” Matt at Surplus Solar Products recommends.

We also advise you take photos of each item and gather corresponding data sheets. Both can help the buyer determine if the item will work for their needs.

3. If you’re crunched for time to conduct an inventory audit, ask for help.

All three of our experts offer services to help solar companies when inventory management has gone on the wayside. Depending on the stock quantity and value, they may come into your place of business. They may help sort the inventory and prepare a master list. They often offer a bid quote on-site. They may also help pack the product for shipment.

“Often we will bid on containers of loose product from someone who doesn’t have the time or ability to sort through it on their own,” advises Hollis at Kinect Solar. “Ultimately, the return on the labor, storage and shipping must be outweighed by the value of the product. Therefore, we do our best to make sure to find win/win situations for all parties.”

One benefit EnergyBin members enjoy is inventory management support. We can work with you to sort through your inventory and upload it to the platform to get you started. This service comes at no additional cost beyond your annual membership dues.

4. Decide how you want to list the product for sale online.

You’ve got two efficient options – either independently list the product or partner with a qualified solar equipment broker who can help.

List the product on your own:

If you decide to list product yourself, know that no two online platforms are the same. Consider the following tips:

- Identify your target audience, and match appropriate sites. Are you targeting end users? Or, do you want to connect to other solar companies who are looking to buy wholesale solar equipment?

- Review Terms of Use for each platform before registering. Many sites advertise free registration but charge transaction fees at the time of sale. Transaction fees can add up quickly.

- Determine your payment and shipping terms. Some online platforms have specific terms that all sellers must comply with. You’ll want to confirm your daily operations can meet such terms before signing up with a platform.

- Set goals, a budget, and a timeline for getting project tasks done. You may want to include some discretionary funds to promote the product, such as pay-per-click (PPC) or banner ads that drive buyers to your listing. If you have a goal of selling your excess stock in three months, mark the date on your calendar and then work backwards to set day-to-day tasks.

- Designate a point-person if you won’t be the person to handle the upload, manage communications and deal with the sales transaction. Your point-person needs to be available to promptly respond to buyer inquiries.

Partner with a solar equipment broker:

If you choose to work with an equipment broker, take care to verify their reputation. By doing so, you reduce your risk of partnering with someone who lacks competence or follow-through.

“There are plenty of brokers and resellers in the market. Make sure you are dealing with someone who has a solid reputation and can stand behind their commitments,” warns Hollis at Kinect Solar. “Unfortunately, the [solar] market (like any market) has its bad apples who may not honor commitments.”

We recommend you review the article, 8 Best Practices of Wholesale Solar Equipment Resellers, to know what to look for in a reputable broker.

5. Know the value of your excess stock.

When we interviewed them, our experts had a lot to say about pricing your excess stock. From time to time, they’ve had to walk away from deals because the seller’s expectation of the item value was overstated, and the seller was unwilling to budge on price.

“Be smart about the value of the product,” advises Stephanie at Ontility. “Be open to negotiating. If the product is good, then it will sell. But over-pricing and setting expectations above the market value doesn’t attract buyers."

Knowing pricing through and through is a core competency of equipment brokers. They have a constant pulse on global market ebbs and flows.

“Understand that the solar market acts much like the stock market or any other commodity market,” explains Hollis at Kinect Solar. “What you purchased the product for may not represent its current value. Sometimes value can increase or decrease depending on the market. Generally, when supply is short, prices increase. But when the market is over-supplied, prices will decrease.”

6. Package your items well to prevent damage during shipping.

Once you have successfully negotiated a sale for your excess stock, package it properly and securely. You don’t want to risk your new buyer receiving damaged goods. Not only would the buyer demand a refund, but they may also slam your company’s reputation.

Matt at Surplus Solar Products comments how important packing is when dealing with loose panels. “These panels are far more susceptible to shipping damage when they are not packed in the manufacturer’s original packaging. Less than load (LTL) carriers will stack other material on top of these pallets no matter what you use to try and stop them.”

If you need help with packing, contact a solar equipment broker for advice.

7. Plan to do it again.

In the moment, you may think selling excess stock is a one-time transaction. But as explained in this article, there are many reasons why excess stock occurs. Developing a pipeline for selling excess stock online will save your company time and money in the future. Plus, you’ll build your network in the process.

Perhaps you’ve also realized that selling excess stock could be a new business opportunity for your company. If you have what it takes to be a solar equipment broker, consider adding this function to your business model.

Conclusion

Excess stock is an unnecessary financial burden for solar companies, especially in a global industry where solar is growing at record-breaking rates.

Be prepared when your business is faced with unwanted excess stock. Know the reasons why excess stock occurs. Understand the cost associated with holding it. Prepare and execute a plan to list stock online.

And consider the selling tips from the solar equipment brokers spotlighted in this article. Brokers can give your excess stock new life and put much needed cash in your pocket.

Just think, the product sitting in your warehouse today could help someone else tomorrow to advance solar throughout the world.

More Resources

A Comprehensive Guide to Wholesale Solar Equipment Brokering?

A Comprehensive Guide to Wholesale Solar Equipment Brokering?

The Ultimate Guide to Buying Wholesale Solar Equipment

The Ultimate Guide to Buying Wholesale Solar Equipment

The Ultimate Guide to Selling Wholesale Solar Equipment

The Ultimate Guide to Selling Wholesale Solar Equipment