The following article is the transcript from a conversation with Melissa Schmid, marketing communication manager, and Thomas Hennessey, business development manager at EnergyBin, who share insights about PV module wholesale prices, secondary market trends, and what to expect moving into H2 2022.

Click on the video to view the interview.

Hello. Welcome to this edition of Market Watch brought to you by EnergyBin, the leading B2B wholesale exchange for PV resale.

I’m Thomas Hennessey, business development manager at EnergyBin, and I’m joined by my colleague, Melissa Schmid, who is our marketing communication manager. Thanks for being here, Melissa.

Today, we’re discussing PV module wholesale prices within the secondary market. EnergyBin recently published the PV Module Price Index report.

1. Tell us about the report. Where does the data come from?

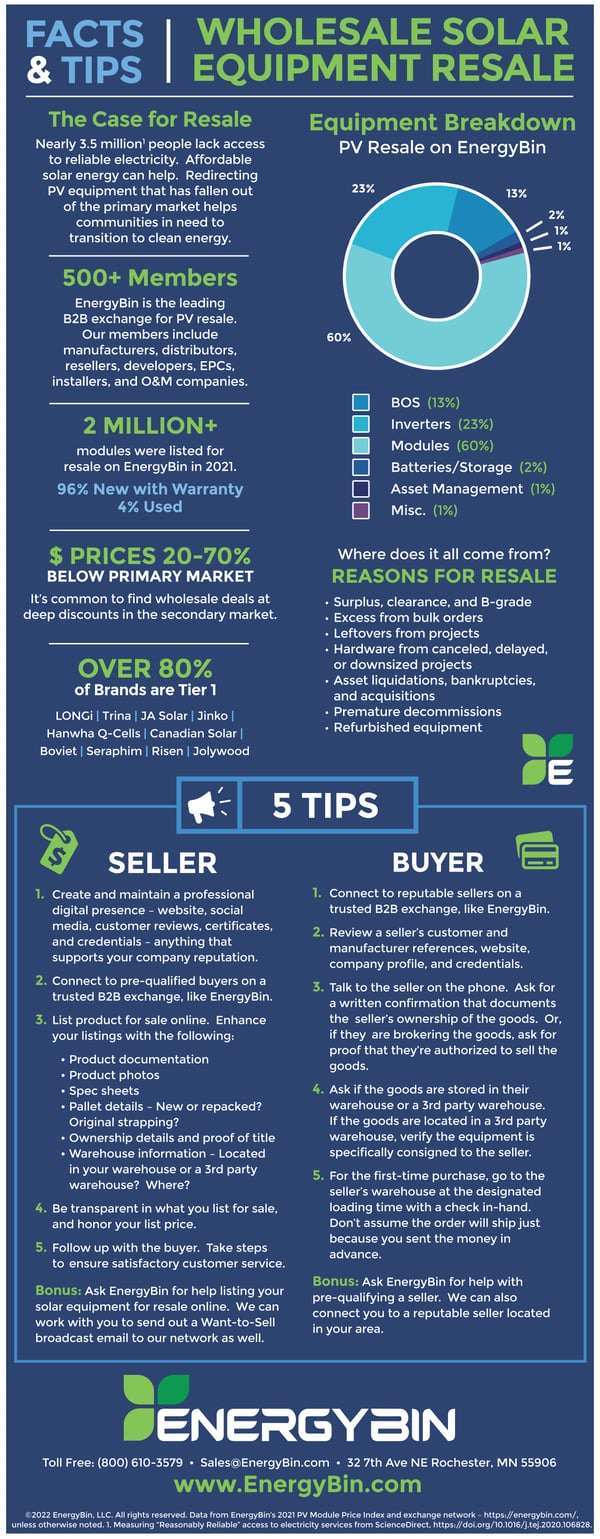

Melissa: The PV Module Price Index is our first attempt to measure resale activity on the EnergyBin B2B trading exchange. Results are based on crystalline-silicon modules that our 500+ members posted for resale in 2021, which totaled over 2 million panels, or 745 megawatts. These are panels that have fallen out of the primary market for one reason or another, and therefore are considered secondary market goods.

We’re excited to share our data for the first time since our exchange platform launched five years ago at Solar Power International (2016). The secondary market has been slow to start, but within the past two years, we’ve seen a big increase in activity on our exchange.

Thomas: Yes, I agree. We’ve seen many solar companies have success using EnergyBin to list equipment for resale. This report really is the first effort to track secondary market activity. I should note that although the report is specific to c-Si modules, solar companies also resell inverters, BOS equipment, batteries, and other components on the EnergyBin wholesale exchange. The report tracks module trade only because, other than labor, modules make up the largest bulk of the project. When it comes down to the wire, module prices can make or break a project budget.

Melissa: That’s exactly right, Thomas. We also decided to report on module prices because modules for resale on EnergyBin comprise 60% of total equipment breakdown, and lately, modules have received a lot of attention in the political economic scene. Last February, Section 201 import tariffs were extended for another four years. The Withhold Release Order remains in effect on panels suspected to contain materials from the Xinjiang province in China. Now, the U.S. Commerce Department is investigating whether imports from Southeast Asia are circumventing anti-dumping rules that limit imports from China. All of these issues, along with supply chain constraints, put pressure on project budgets and timelines.

2. You mentioned that modules listed for resale on EnergyBin have fallen out of the primary market for one reason or another, and therefore are considered secondary market goods. Would you explain some of these reasons?

Melissa: There are a number of reasons why modules and other solar goods fall out of the primary market. The main reasons for resale stated by our members include:

- Surplus, clearance, or B-grade

- Excess from bulk orders

- Leftovers from projects

- Material from canceled, delayed, or downsized projects

- Asset liquidations, bankruptcies, and acquisitions

- Premature decommissions (meaning the modules are not yet at end-of-life when they come offline)

- Refurbished equipment

I've also heard of cases where a building or land changes ownership hands, and the new owner doesn't want the existing solar system.

Thomas: That's interesting. Another reason to add to the list is roof replacement. Sometimes, a solar system is disconnected and dismantled for a new roof, and the owner may decide not to reconnect the solar system. I just spoke to a homeowner the other week who would prefer to resell her solar system rather than reconnect it.

3. Would you explain more about the sample size that the PV Module Price Index analyzed?

Melissa: Of the 2 million modules listed for resale, 96% were new with warranty, and 4% were used. We grouped modules into technology classes, which were All Black, Bifacial, High Efficiency, Mainstream, Low Cost, and Used. Over 83% of the modules fell into the categories of All Black, High Efficiency, and Mainstream. Across all module types, power wattages ranged from 120 watts to 540 watts, with over 80% being 300 watts and higher.

Thomas: Wow! It seems like this sample size dispels the myth that PV modules for resale are just a bunch of junk. All of these panels are really high quality material.

4. What are the key pricing trends revealed in the PV Module Price Index?

Melissa: We found that although deep discounts exist, the secondary market is not immune to inflation. However, prices across all technology classes appeared to be comparable to or lower than national average trends. For the whole of 2021, industry analysts estimated a range of 12.5% to 17.5% price increases for domestic and imported modules, depending on volume ordered. Prices on EnergyBin reported at or below these levels, and some prices were comparable to global prices, which surprised me. For example, High Efficiency modules were listed as low as $0.24 per watt and Mainstream modules as low as $0.25 per watt. A seller’s decision to list a discounted price usually has to do with their need to liquidate assets quickly.

Thomas: I agree. I’ve spoken with many companies who tell me they are cash-flow poor and project rich. Since many projects are custom built, it’s often easier to resell material from a canceled project to free up cash rather than to roll that material into a new project.

Melissa: Another trend that surprised me was that despite fluctuations in 2021, the price index revealed that secondary market module prices did not increase significantly from January 2020. Other than All Black modules, which saw a 25% increase, prices in each module class didn’t change beyond what may be expected from year to year. In the High Efficiency and Low Cost classes, 2021 prices actually decreased by 5% from January 2020 prices.

Thomas: That’s amazing! You’re referencing technology class, and it sounds like the bulk of resale volume on EnergyBin is high quality. But I’m wondering about the bankability of these modules.

5. Did the PV Module Price Index report on manufacturers' brands? How many are Tier 1 modules?

Melissa: I’m glad you asked that question. The report found over 80% of the modules listed for resale on EnergyBin were from the top 50 Tier 1 manufacturers. Some of the top brands were LONGi, Trina, Canadian Solar, Hanwha Q-Cells, and Boviet.

6. What pricing trends can we expect in the second half of this year?

Melissa: It’s a bit hard to know what to expect due to the nature of the secondary market, which seems to be in continuous flux. However, I’m in agreement with industry analysts who have stated they don’t anticipate module prices to stabilize or fall in the near future. Supply chain issues, such as shipment delays, extended transit times, and increasing freight costs, will most likely persist through 2022 and into 2023. Labor shortages and raw materials costs will also affect module pricing.

Thomas: It really does seem like the secondary market tends to ebb and flow even more so than the primary market at times. I think this is because the secondary market supply changes frequently. I was amazed the other day to see an EnergyBin member post 25 megawatts of Hanwha Q-Cell high efficiency panels for resale. We may see more bulk volumes if additional projects get canceled or downsized.

7. How can solar companies keep tabs on module pricing going forward?

Melissa: Market intelligence is key. Exchanges, like EnergyBin, make it easy to get a bird’s eye view of what’s going on in terms of pricing, as well as product availability. Of course, an exchange is only effective if you log in on a regular basis.

Thomas: I agree, and with the market changing every day, logging in really has to become part of your daily business operations to stay informed.

Wrapping it up, I want to thank you, Melissa, for your insights and keeping us up-to-date with secondary market trends.

For our viewers, download the PV Module Price Index report at EnergyBin.com, and subscribe to our YouTube channel.

From the entire EnergyBin team, we wish you success in your work to advance solar energy. Thank you for all you do, and thanks for watching.

More Resources:

The Ultimate Guide to Buying Wholesale Solar Equipment

The Ultimate Guide to Buying Wholesale Solar Equipment

The Ultimate Guide to Selling Wholesale Solar Equipment

The Ultimate Guide to Selling Wholesale Solar Equipment