Solar equipment brokering is all about keeping a pulse on the market and responding to demand. Brokers, who also go by the names of consultants, resellers, and traders, are a key stakeholder group within the solar industry to accelerate the adoption of solar energy. They do so by moving PV equipment from sellers to buyers quickly and efficiently, a critical role during times of supply shortages and rising prices.

Whether you’re currently operating as a solar equipment broker, or you’re interested in expanding your business model to include resale, this article is meant to help you prepare for the upcoming year. Understanding current supply chain challenges that solar companies face is necessary in order to best serve them with your value-added solutions.

Supply chain constraints and forecast

Rising PV prices coupled with supply chain constraints are hindering the global solar industry. In the last year, solar modules have increased from an average $0.20/Wp to $0.26-0.28, according to Rystad Energy, a Norwegian business intelligence firm.

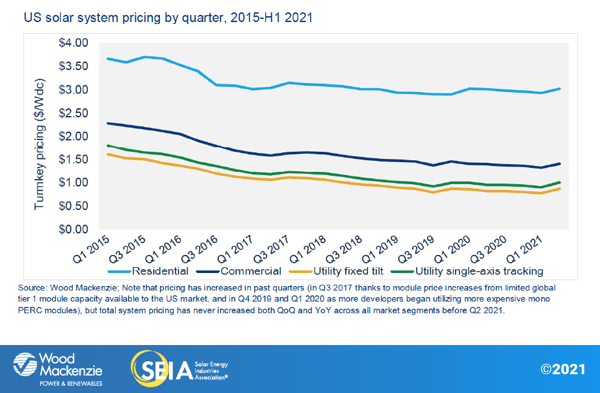

In the United States, Wood Mackenzie reports that this is the first time that module prices have increased quarter-over-quarter and year-over-year across all U.S. market segments since 2014.

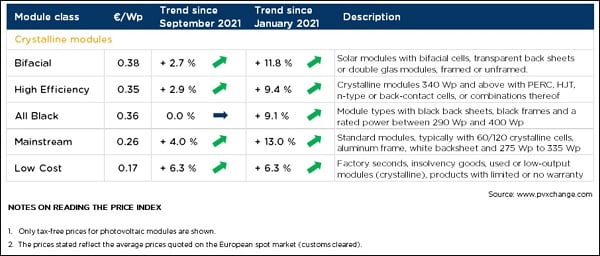

In Europe, PVXchange has seen prices for all crystalline module types bounce back to 2019 levels and does not anticipate a steady price decline in the foreseeable future.

Price increases are causing industry players across the supply chain to renegotiate contracts. If a contract can’t be adjusted, sellers will either have to reduce their margin, or they’ll risk the project being canceled.

In addition, freight costs have jumped from $0.005/Wp in September 2019 to $0.03 in October 2021. Rystad warns that these increases could result in the delay or cancellation of up to 56% or 50 gigawatts (GW) of global utility-scale PV developments planned for 2022.

Along with rising costs, delays still persist. Bottlenecks at ports of Los Angeles and Long Beach in the U.S. as well as at ports of Yantian and Ningbo-Zhoushan in China continue to experience multi-week backlogs. In the U.S., the Biden Administration convened the Supply Chain Disruptions Task Force that recently announced a series of public and private commitments to accelerate the movement of goods from west coast ports throughout the country. UPS and other major companies now operate at 24 hours/7 days per week capacities.

Regarding overall new module supply, total global shipments are down 11% compared to Q3 2020, according to S&P Global Market Intelligence. Some U.S. imports are currently being held at ports under the Withhold Release Order (WRO) issued last June. In order to free these shipments, the solar industry must prove that supply chains contain no material sourced from Hoshine province suppliers. Currently, module imports to the U.S. are down 27%.

Meanwhile, demand continues to climb in the U.S. and around the world. Globally, the International Energy Agency (IEA) reports a 45% year-over-year increase of added solar and wind capacity in 2020 totaling 280 GW. Such an increase hasn’t occurred since 1999. The IEA forecasts similar increases to continue through 2022.

In the United States, new forecasts from Wood Mackenzie reveal an average of just over 29 GW of new annual solar capacity additions through 2026. In the Solar Futures Study released in September by the U.S. Department of Energy, researchers note an average of 30 GW of added capacity is needed each year between now and 2025, followed by 60 GW per year from 2025-2030, to attain 40% of the nation’s electricity supply provided by solar by 2035, a total capacity of 1,000 GWac. By 2050, solar capacity would need to reach 1,600 GWac. These amounts represent the deployment of solar necessary to achieve a decarbonized grid.

Even with price increases continuing through 2022, world leaders recognize the importance of accelerating the clean energy transition, and therefore, PV professionals must keep pressing forward as best they can.

Preparing for a prosperous 2022

How can you gain opportunity during these volatile times and support the surging demand for solar? Now, more than ever, the industry needs solar equipment brokers to step up and do what you do best.

The resourceful solar equipment broker locates PV material not in use and seeks to acquire it from the current owner in order to remarket the material to new buyers who can deploy it today.

“It’s surprising how quickly product can move in the secondary market,” states Thomas Hennessey, business development manager at EnergyBin, a B2B trading exchange for PV professionals to buy and sell solar equipment. “One of my clients, a solar installer located in California, recently sold a full list of excess material within a few days.”

Activity on the EnergyBin exchange has increased fivefold in recent months giving testimony that solar companies are seeking alternatives to source and sell equipment. Auction sites, Craigslist, and eBay are also commonly utilized by sellers to remarket PV equipment.

Heading into 2022, solar equipment brokers can carve your niche by implementing the following tips.

1. Proactively hunt down excess solar panels, inverters, and BOS parts.

Contact solar companies, like distributors, EPCs and installers, to inquire about inventory they’d like to liquidate. Oftentimes, companies are too busy to tackle warehouse cleanup. They don’t have the manpower to sort through older inventory. You can to do this task for them and offer a cash buyout for material that has resale value. You could also use a consignment or commission-based model where you pay for the goods after you make a sale.

If they push back on you by stating they’re holding onto excess because of supply shortages, be ready to share your expertise with them.

“Some solar companies may be tempted to hoard equipment in anticipation of shortages, but unless they are confident they can use that exact material for a contracted project in the near future, I advise companies to sell now,” states Thomas. “The longer they hold onto equipment, the more it depreciates.”

That’s primarily due to manufacturers introducing new technologies every 9-12 months. For instance, BayWa r.e. expects to receive new JA Solar 530W modules at their California and New York warehouses in December. Every time a higher efficiency module is made available for sale, lower efficiency modules lose value.

Inverter technology is also changing quickly, partly in response to new electrical codes. Enphase has released the new IQ8 family of products. The new SolarEdge Synergy product line will hit the market by year-end. With every new upgrade, the risk of older models becoming obsolete increases.

Inform your prospective clients that now is the time to sell and that you can also help them to buy material in the future (see Tip 4).

2. Don't toss legacy solar equipment.

Not every buyer is in the market for the latest and greatest technology. On EnergyBin, Thomas works with a number of buyers who are looking for replacement parts for older systems.

“I’ve heard from O&M companies and installers who maintain aging systems that their customers oftentimes prefer they find replacement parts over swapping out an entire system.”

Especially if the equipment is new, there is a high likelihood that it will resell in the secondary market. If the equipment is used, you’ll have to test it for functionality, safety, and power output to determine whether the equipment has resale value.

3. Post solar equipment for sale online.

Selling solar equipment online exposes your company to prospective customers beyond your geographic region. Buyers use e-commerce marketplaces and B2B exchanges to compare prices and search for product availability.

One of the main advantages of using an exclusive B2B exchange, like EnergyBin, is that members must pre-qualify to gain access. Thomas reminds sellers that EnergyBin makes it easy to sell excess product quickly, as all buyers on the platform are vetted solar companies.

“My advice to sellers is to post your equipment for sale on EnergyBin, and send a Want-to-Sell broadcast to reach new buyers. Product searches are based on elastic keywords, so include a complete product description when uploading inventory. Plus, sending a broadcast is essentially sending a mass email to all members. The broadcast messages are a powerful way to draw attention to what you have for sale.”

4. Act as a buying agent.

Help buyers find the equipment they need to keep their project timelines on track. Win them over for a long-term relationship by proving you can present quotes for quality equipment at competitive deals.

If you’re an EnergyBin member, you can send Want-to-Buy broadcasts for single parts and full systems on behalf of your clients. This is an easy way to get quotes from multiple suppliers quickly, rather than doing grunt work to track down material.

“Want-to-Buy broadcasts are powerful because of their convenience,” notes Thomas. “Sellers are conditioned to watch for these notices on a daily basis, so buyers typically get responses within 1 business day. I recommend getting into the habit of using this tool on a regular basis.”

5. Provide solutions for other supply chain concerns.

Sourcing and selling solar equipment on behalf of clients only partially fulfills their needs. Material movement is another big concern. Find ways to provide freight and logistics services either in-house or by partnering with another company, like a freight brokerage firm.

This piece of your business could be offered in conjunction with equipment brokering or as a stand-alone service. For example, if you’re hired to take inventory of a solar company’s warehouse, and you find end-of-life modules that have no resale value, then you could offer to move them to a recycling facility for a negotiated service fee.

“Supply chain constraints are challenges but not impossible to work around,” encourages Thomas. “Pay attention and listen well to your clients’ concerns. Be flexible with them, and think of strategies that lead to solutions, rather than dwelling on the negatives.”

Move beyond shortages and constraints

Industry analysts believe solar equipment shortages and supply chain constraints will continue through 2022. Such challenges will cause many companies to seek alternatives for sourcing and selling.

As a solar equipment broker, you have the opportunity to fill in the gaps. You play an integral role in advancing the adoption of solar energy around the world. You excel at locating dormant equipment and redirecting it to buyers who are ready to install today.

In the words of Abigail Ross Hopper, president and CEO of SEIA, “While we’re poised for more growth, we must accelerate solar and storage deployment to address the climate crisis and reach ambitious clean energy goals.”

It’s time to take up the torch and run.

Additional Resources

PV Price Spikes: How Solar Companies Can Offset Supply Chain Issues

PV Price Spikes: How Solar Companies Can Offset Supply Chain Issues

5 Tips to Sell Wholesale Solar Equipment Online

5 Tips to Sell Wholesale Solar Equipment Online