Last updated: January 30, 2024

Overview

The future of solar is bright. But soft costs, including supply chain overhead, remain high in the United States. Online B2B exchanges help to reduce costs by connecting industry players around the world. On such centralized networks, buyers and sellers across the supply chain are ready to deal, and a new player emerges – the solar equipment broker – in response to a growing need and in expectation of great opportunity.

In this article, we'll cover how solar companies and brokers are using an online B2B exchange, EnergyBin, to leverage their networks and reap significant results.

U.S. solar market review and forecast

Before we explore the online B2B exchange concept, let’s review where we're at in the U.S. solar market and what we can expect in the near future to establish the need for equipment brokers and online B2B exchanges.

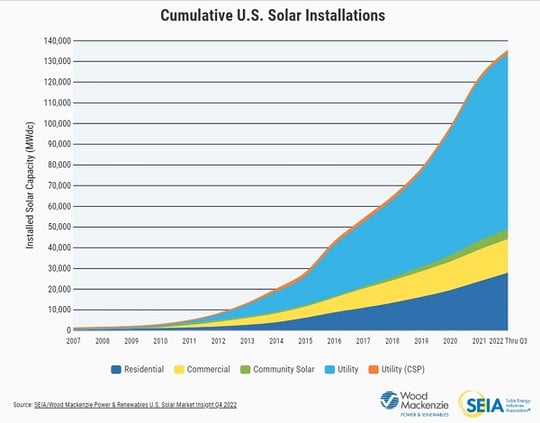

To-date, the United States has installed more than 161 GW of solar, which amounts to 4.7 million systems. According to SEIA, over the past ten years, the solar market has grown by an average of 24% every year. The U.S. will remain one of the top three world markets with rapid growth for the years to come.

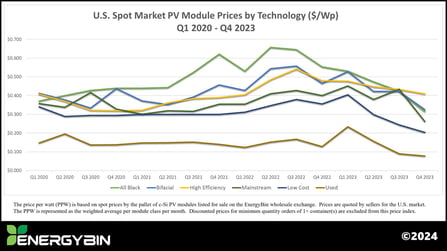

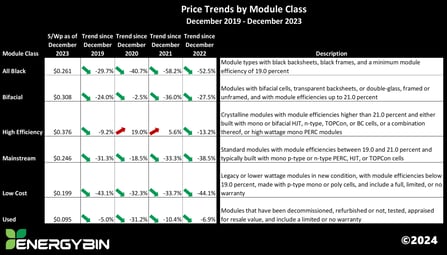

Growth is driven by falling prices, particularly hardware costs. The Department of Energy reports the average cost of solar panels has dropped by more than 60% since 2010. Both module and inverter costs somewhat leveled out in 2020, according to industry analysts. However, recent supply chain constraints, including raw material input and freight costs, caused equipment prices to creep up 6-8% for equipment sourced in the primary market since the global coronavirus pandemic.

The secondary market also saw hardware costs increase between 2020 and H1 2023 when module prices took on a downward trend. Per EnergyBin's 2023 PV Module Price Index, c-Si module prices for all technology classes have dropped to below 2020 levels.

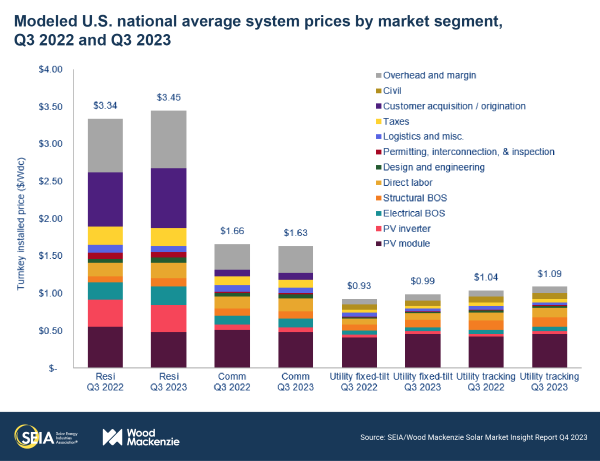

In the latest edition of the U.S. Solar Market Insight report published by SEIA and Wood Mackenzie, national medium system prices are $3.45/W for residential installations, $1.63/W for commercial projects, $0.99/W for utility fixed-tilt projects, and $1.09/W for utility tracking projects.

The average-sized residential system has dropped from more than $40,000 in 2010 to nearly $17,000 today, before incentives. But we all know there is still more work to be done to bring the cost of solar down for solar to ultimately become a mainstream consumable product and make a greater impact on climate change.

Solar soft costs remain high

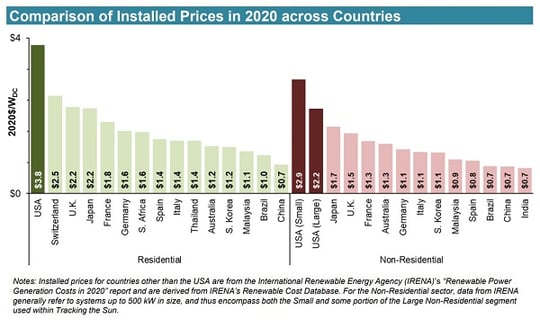

Yet, soft costs are still higher in the U.S. than other countries. You can see on this graph how much of a variance that causes with respect to price per watt from country to country.

Resource: Lawrence Berkeley National Laboratory

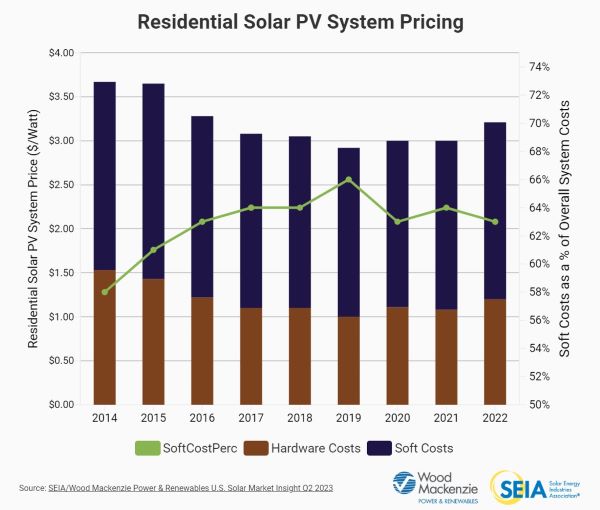

Soft costs include installation labor, installer margins, permitting, inspection, interconnection, supply chain overhead, financing fees, customer acquisition and other business process costs. As you can see on this graph, soft costs have increased significantly for residential systems since 2014. Even with the decline over the last few years, soft costs still make up more than 62% of total cost. Plus, with labor shortages and supply chain constraints, soft costs will most likely increase again this year.

Resource: Solar Energy Industries Association

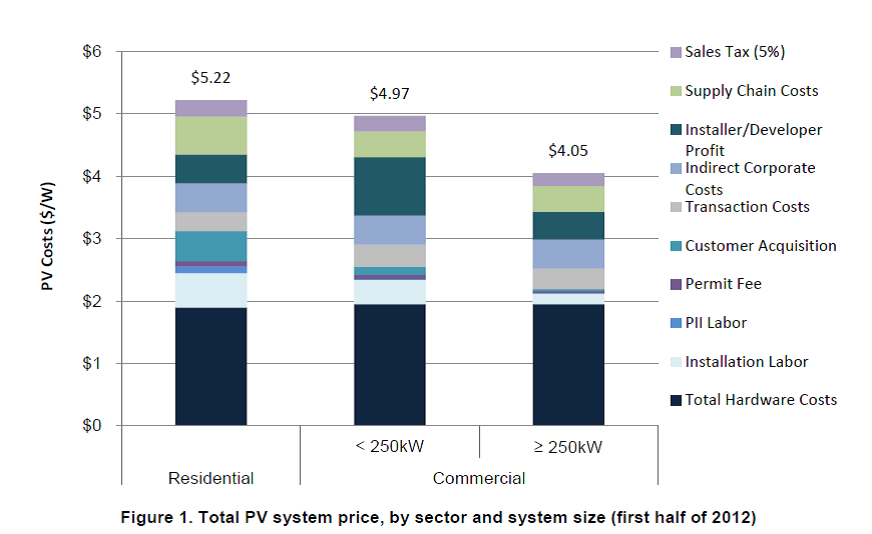

When the National Renewable Energy Lab (NREL) published its 2nd Edition of the study, “Benchmarking Non-Hardware Balance-of-System (Soft) Costs for U.S. Photovoltaic Systems, Using a Bottom-Up Approach and Installer Survey” in 2013, total soft costs were reported to be 64% for residential systems, 57% for small commercial systems (<250 kW) and 52% for large commercial systems (≥250 kW).

Resource: National Renewable Energy Lab

When we compare soft costs from 2013 to today, the reality kicks in that soft costs have remained nearly constant, as the U.S. Department of Energy reports. The NREL 2013 report noted that one of the highest soft costs across all project types is that of supply chain costs at 11.7% for residential systems, 8.4% for small commercial systems, and 10.3% for large commercial systems.

A hard look at the solar supply chain

With our current supply chain model – that of the traditional finished product flow from manufacturer to distributor to contractor – we cannot expect supply chain costs to decrease.

The U.S. solar market installed 10.6 GWdc of new solar in 2017, 10.6 GWdc in 2018, 13.4 GWdc in 2019, 19.2 GWdc in 2020, 23.6 GWdc in 2021, and another 18.6 GWdc in 2022. By the end of 2023, the country will install 32 GWdc. If every c-Si and thin-film manufacturer in production today in the United States was producing at full capacity, the country might be lucky to have nearly 16 GW of domestic product—only meeting 50% of demand according to Solar Power World.

However, by 2026, the country's annual production capacity should include 58 GW of modules. Manufacturers are also developing production lines for silicon ingots and wafers. If all goes as planned, the U.S. will reach a total capacity of 669 GW made possible by private investments amounting to $565 billion by 2033.

Within this growing supply chain, how can we guarantee that solar contractors big and small have access to the best prices, and ensure that the right product is available at the right time?

What if we employed another option within the supply chain model that was different from the traditional vertical model?

What if the new option reduced supply chain costs and helped solar companies of all sizes navigate the overall supply chain?

Regarding soft costs, can we reasonably argue that if by using an expanded or evolved supply chain model, then supply chain costs would decrease?

Let’s take a look at a new option in the supply chain, the online B2B exchange, with respect to this hypothesis.

Online B2B exchanges reduce costs

Online B2B exchanges help to close the gap and flatten the supply chain, thus aiding in the reduction of soft costs. We have experienced this first-hand at EnergyBin, the wholesale solar B2B exchange where companies across the supply chain come together to buy and sell new, used, excess, refurbished, and hard-to-find solar equipment at 20-70% below retail cost.

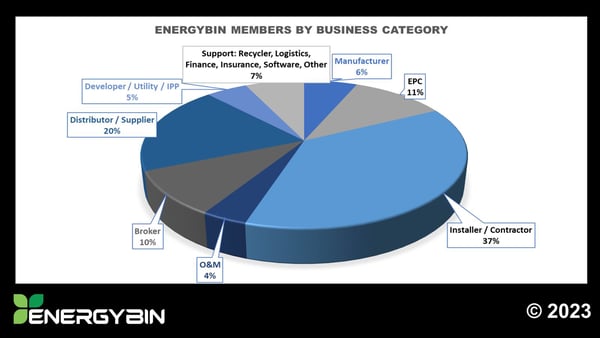

As you can see from this member breakdown chart, there is representation across the standard supply chain. Within this flattened model, any company can buy from and/or sell to any other company.

Members buy and sell from one another based on need rather than on company category. For example, Installer A can buy from Installer B who has the product Installer A needs rather than following the traditional vertical supply chain process.

Why use a wholesale solar B2B exchange

The freedom to buy and sell on the online B2B exchange comes in handy for multiple scenarios.

Locating Hard-to-Find Replacement Solar Panels and Parts

For example, a solar contractor successfully locates hard-to-find parts on the exchange that his/her vendors don't carry.

One EnergyBin member - a commercial contractor - needed some niche racking for a project. They called their manufacturer and distributor, but they couldn’t find the racking they needed. So, they decided to partner with another EnergyBin member - a broker - who scoured his global network to find the equipment. Within two weeks, the product was drop-shipped to the project site.

Obtaining Multiple Quotes

Another example is the ability to secure multiple quotes for those customers who are looking for feasible options, rather than the latest and greatest technology. There can be a big cost difference between the newest model panel and a model from one or two years ago and of which the efficiency levels are nearly the same.

We especially see this to be the case for our solar contractor members on EnergyBin, whose commercial customers consider solar investments with multiple stakeholders’ needs in mind. In one instance, a member reported that he presented multiple quotes to his customer for a 24kW array. The customer selected a Tier 1 panel option from the online B2B exchange in place of the quote obtained from the contractor’s primary vendor.

Reselling Excess Material

Contractors, EPCs, and developers can also use the exchange to resell excess materials from projects. Doing so reduces unnecessary waste and creates an additional revenue stream. The money earned from reselling excess material can offset some of the cost to maintain solar systems.

Finding Older Equipment Models

In yet another scenario, an installer may have a customer who wants to add onto an existing array, but the panels and inverters are older models that the manufacturer no longer makes. The installer has the option to search for the older product on the exchange.

Reselling Used Solar Panels

Or, perhaps the owner decides to remove the system for whatever reason. The system is less than 10 years old, and solar panels are producing power at 80% or higher. Instead of tossing them, the contractor could resell used solar panels on the exchange.

Satisfying a Customer's Need

A final example for consideration is that of a distributor whose customer is looking for a specific product that the distributor does not have. Instead of sending the customer away empty handed, the distributor could search for the product on the B2B exchange. Locating the product for the customer keeps that customer happy and increases trust in the relationship.

We saw this very scenario play out on EnergyBin recently. A distributor was looking for an older model of a utility-sized inverter and connected with another supplier in the network that had the part they needed for their customer. They discovered their companies were located just 20 miles apart from each other. Even though they both are working in the solar industry, they were not aware of each other because of the nature of their work.

In this story, what could have been a very expensive and prolonged transaction moving through a standard supply chain process turned out to be fast and profitable for both companies.

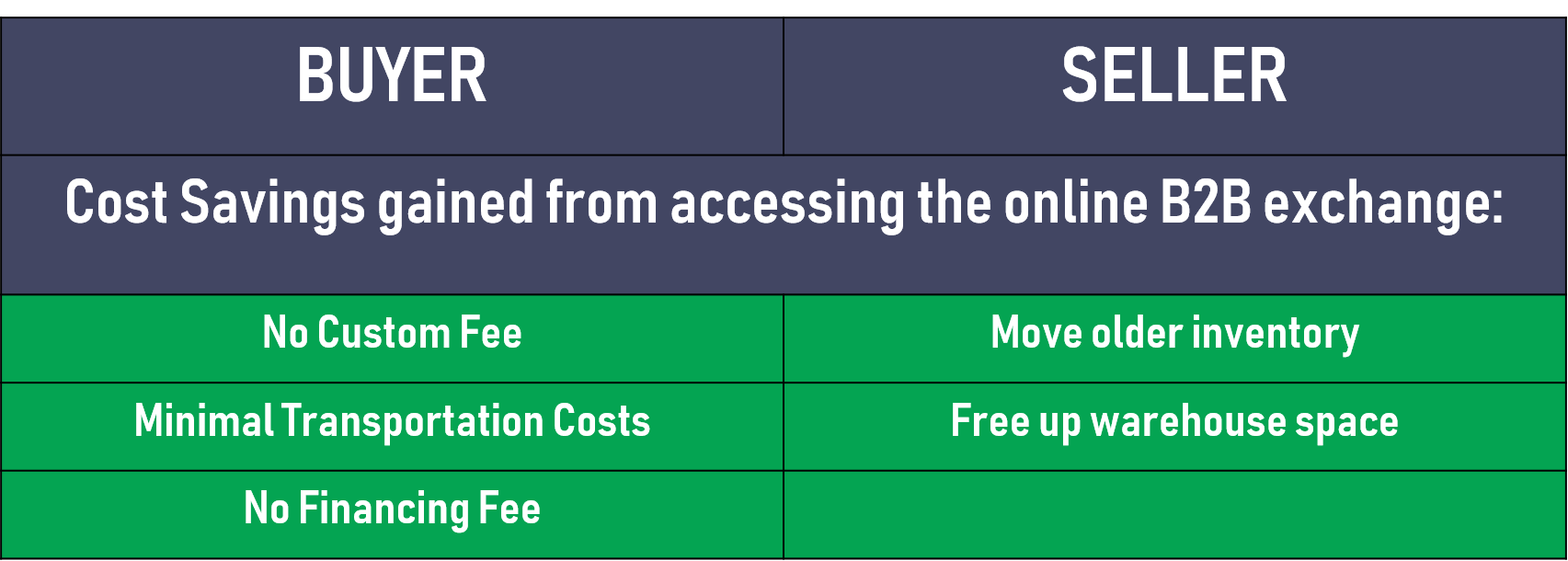

No custom fee was assessed and transportation costs were at a minimum because of the two companies’ local proximity. The buyer was able to quickly satisfy their customer’s need and pay the seller on a net 30 term rather than incurring an interest fee. The seller was able to move older inventory, thus earning a profit on the unused product and freeing up valuable warehouse space.

This story illustrates why it is important to break down the silos that we operate in and create an open communications platform to connect to each other, which online B2B exchanges have the power to do.

U.S. Department of Energy SunShot Initiative Award

These examples illustrate the core of EnergyBin and why the U.S. Department of Energy granted EnergyBin the SunShot Initiative Award five years ago to launch the platform. The DOE created this funding opportunity to specifically boost innovation geared at reducing soft costs.

Although there is no one overarching solution to drastic soft cost reduction, combined efforts across the industry aligned with this ultimate goal are making an impact.

In the case for EnergyBin, we have collected evidence on member activity that supports a minimum of 20% cost reduction on combined hardware and supply chain soft costs.

Returning to our previous hypothesis: If we incorporate the use of the online B2B exchange into our supply chain process, then supply chain costs would decrease. We can reasonably state that the online B2B exchange model is capable of lowering supply chain costs, such as procurement costs, shipping and handling, and warehouse storage.

Equipment brokering solves solar company challenges

Beyond flattening the supply chain, a greater opportunity opens up by way of online B2B exchanges, that of solar equipment brokering.

Just as we’ve observed companies using the EnergyBin exchange advantageously, we have also discovered other challenges solar companies have that prevent them from fully reaping the benefits of a flattened supply chain model.

For example, there are multiple residential and commercial contractors who have excess inventory from over-purchasing, cancelled projects, or delayed projects. Holding this inventory increases inventory costs, such as warehouse storage, internal movement of the product and any interest owed on borrowed money to purchase the inventory.

What would be the logical action to take? Reselling the equipment would be the best case scenario.

But the challenge is finding the time and manpower to take note of the stock and re-position it online for sale to a qualified group of buyers. In this case, it would be to your advantage to invite a broker into your business to take note of the inventory and offer you a sum payment.

Another example along the same lines has to do with not having the connections in the industry to benefit from optimal procurement pricing.

Perhaps a contractor would like to gain better pricing on solar equipment or explore ways to lower supply chain costs like freight, but the company is strapped for time to search product listings, compare pricing, and vet new vendors and really doesn’t have access to a global network.

A strategy to overcome this challenge would be to partner with a broker who could do the leg work for you, freeing up your time and resources to focus on other priorities.

Enter the solar equipment broker

It is within the realm of these very challenges solar companies face that equipment brokers have carved out their niche.

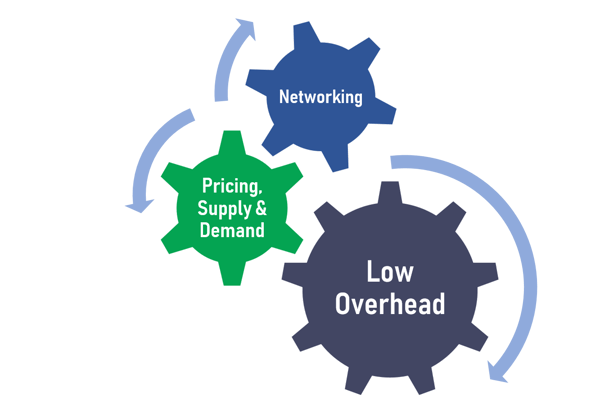

Brokers are exceptionally good at networking and building relationships, knowing equipment pricing through and through, and maintaining minimal overhead costs.

We have witnessed brokers in action for nearly 20 years on our company sister site, BrokerBin, which is an online B2B exchange operating in the IT industry.

Over 13,000 brokers around the world use BrokerBin daily to connect, buy and sell IT components. They are astute with respect to who needs product and who has product to sell. Their superb communication and negotiating skills coupled with their shrewd knowledge of transportation logistics ensures clients get what they need at the price they want when they need it.

Common characteristics of equipment brokers

On EnergyBin, we have been tracking equipment brokers who have emerged since the platform launched in 2016. Although we have observed a number of different business models, we have noticed some consistencies from broker to broker that contribute to their success.

- Brokers use EnergyBin to network and keep tabs on market intelligence in addition to attending trade shows and other networking events.

- They are quick to reach out to our account representatives for leads and consider our reps as an extension to their teams.

- Brokers are listing inventory on EnergyBin and sending out Want-to-Buy and Want-to-Sell emails for specific equipment. They are proactive in their communications. They seek out business deals rather than waiting for business to come to them.

- Their listed inventory for sale is competitively priced and usually lower than what can be found through the traditional supply chain.

- Their equipment for sale is guaranteed in quality per industry standards and almost always backed by the manufacturer’s warranty. In some cases where the manufacturer’s warranty does not apply, for example refurbished solar panels, brokers have the means to provide a warranty backed by their assets.

- Brokers represent clients throughout the world, not just in the United States.

Equipment brokering leads to big opportunities

Let’s look at an example of how one broker has capitalized his business objectives on EnergyBin. The following quote is from a broker based in California who deals in equipment trade for domestic and international megawatt projects. The quote reads:

“Through the connections I’ve made on EnergyBin, I have tremendously increased my revenues. It didn’t take long to build relationships with other members who were ready to deal.”

This member joined EnergyBin in November of 2017. He got to work with his account representative to identify qualified leads in the EnergyBin network. By June, he called us to share good news. He successfully negotiated two deals with other EnergyBin members.

In the first deal, he purchased panels from a member for a 15 MW project at a cost savings of $0.04 per watt. He then sold the lot to his client at his markup. In the second deal, he sold panels for a 1.6 MW project to a member at a $0.05 per watt markup.

The broker reported to us that he had achieved a cost savings total on these two deals of $680,000. Since EnergyBin does not charge transaction fees, this broker achieved a 453x return on investment of his annual membership dues thanks to these two connections made on the exchange. Beyond this outcome, he stated that his company revenues tripled in less than one year after joining EnergyBin.

Equipment brokering - A need in the solar industry

Not only is equipment brokering a big opportunity as exemplified by this story, but it’s also a need according to many of our clients from manufacturers to suppliers who are looking for qualified sales professionals to resell their product lines.

For instance, one of our members, ATEN Solar, a broker who specializes in surplus product, reported that his business has grown to the point where he needs additional representatives to help move his inventory. You can read ATEN’s case study on our website to learn more about the company.

How to become a solar equipment broker

There are two main ways we see individuals transition into equipment brokering. They tend to either launch their own business like the story about the broker from California, or they go to work for a company like ATEN to learn from a pro.

Either way, we would recommend finding a good mentor in the field, who can advise you on your journey.

You may also find our Comprehensive Guide to Wholesale Solar Equipment Brokering to be a valuable resource.

Final thoughts

To sum up, with the ongoing rapid growth of the solar industry world-wide, it is crucial that we, as a collective industry, continue to achieve processes that reduce soft costs and minimize waste.

One such process that is proving cost savings of 20+% is that of the online B2B exchange, which flattens the supply chain and opens communication between solar companies around the world.

With such B2B exchanges comes new business opportunities, such as solar equipment brokering. This particular opportunity is an essential need to further lower supply chain costs and advance solar throughout the world.

More Resources

Want to learn more about wholesale solar equipment brokering? Check out more resources here.

Want to learn more about wholesale solar equipment brokering? Check out more resources here.