The third annual (2023) PV Module Price Index - Secondary Solar Market report is now available for download.

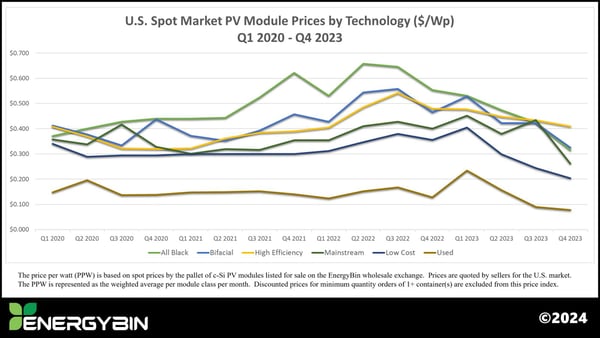

The PV module price index tracks wholesale pricing and supply of crystalline-silicon modules that have fallen out of traditional distribution channels, and as a result are listed for resale on the EnergyBin exchange.

For the third year, the report findings shed light on the importance of a robust and sustainable secondary solar market to minimize waste and maximize asset recovery. The value of a secondary market increases as reuse of PV modules not yet at end-of-life becomes common practice.

As a B2B wholesale solar equipment exchange comprised of 500+ member companies, EnergyBin facilitates the connection of solar companies looking to buy and sell PV hardware. Although transactions do not take place on the EnergyBin platform, sales listings documented more than 5.4 million modules (or 2.13 gigawatts) posted to the site from January 2020 through December 2023. Over the three-year period, solar panels listed for resale on the exchange increased by 29 percent, an indicator that the secondary market is gaining momentum.

“For the third year in a row, the PV Module Price Index has provided data that points to a growing secondary solar market,” says Renee Kuehl, COO at EnergyBin. “What’s clear from this price index is that remarketed modules, whether new or used, often retain resale value. Even as global prices plummeted in 2023, the price index highlights some level of incubation within the U.S. market.”

In December, the spot price for mono PERC modules on EnergyBin of $0.246/Wp was nearly double that of the global spot price of $0.125/Wp. All Black and Bifacial modules were $0.261/Wp and $0.308/Wp respectively.

The PV Module Price Index is a resource for solar professionals to accurately track modules traded within the secondary market. This year’s report comes with some key changes to portray more precisely what’s happening in the market. These changes include:

- Module class descriptions have been updated to reflect changes in technology. As modules increase in efficiency rates, demand for higher efficiencies also increases. With over 80 percent of modules listed for resale on EnergyBin now at efficiency rates of 19.0 percent or higher, the new class descriptions more accurately represent those modules that wholesale buyers and sellers are trading day-in and day-out.

- This year’s report includes a comparison of U.S. spot prices for “Made in USA” modules versus imports, as they’re listed for resale on the EnergyBin exchange. “Made in USA” modules tend to range 40-45 percent higher than imports (excluding western Europe-made imports).

- The report provides an average PPW comparison of modules by seven top global brands by shipment volume – Canadian Solar, JA Solar, Jinko Solar, LONGi, QCELLS, Risen Energy, and Trina Solar – as a bird’s eye view of brand value retention in the secondary marketplace.

- Finally, the report includes two Company Spotlight interviews from EnergyBin members, Aten Solar and MinnSolar, who are PV module experts. These interviews add field insight to this report.

Another indicator that the secondary market is gaining momentum is the increase in used solar panels for resale. Since 2020, the volume of used modules listed for resale on EnergyBin has increased by 282 percent. Such modules can be redeployed as replacement parts for or add-ons to existing systems, utilized in off-grid systems, and repurposed into new, lower energy consuming builds. Furthermore, as these modules reach their end of life, the reuse supply flows seamlessly into recycling channels completing the circular economy loop.

“With the rapid growth of the global solar industry, the secondary market will also continue to grow," notes Kuehl. "Growth leads to new opportunities. In the secondary market space, we'll see these opportunities manifest in the areas of resale, reuse, repair, remanufacturing, and recycling, as well as value-added services that complement these business functions. All are necessary components of a sustainable circular economy."

Additional Resources:

A Comprehensive Guide to Wholesale Solar Equipment Brokering

A Comprehensive Guide to Wholesale Solar Equipment Brokering

The Ultimate Guide to Selling Wholesale Solar Equipment