Reuse is a key element of the circular economy. In lucrative industries, such as information technology and solar, asset owners regularly upgrade system hardware to maximize performance yields. Often, upgrades occur prior to a product’s end-of-life.

Enter the asset disposition reseller. This person is the expert who excels in product lifecycle solutions.

Trusted resellers oversee asset recovery and remarketing of used hardware. Additionally, they work with customers to redirect end-of-life assets to recycling facilities. Such market players can be found in both the IT and solar industries.

EnergyBin recently chatted with two ITAD leaders, Corey Donovan, president at Alta Technologies, Inc. (AltaTech) and Dave Manning, senior product manager of asset lifecycle management at Iron Mountain. The conversation pointed to numerous parallels between IT and solar hardware resale.

Both AltaTech and Iron Mountain have a global footprint and serve Fortune 1,000 enterprises and larger. Their experience with data management, asset recovery, logistics, refurbishing, and remarketing gives insight to solar companies and PV system asset owners who are overseeing decommissioning projects and reselling secondhand solar panels, inverters, and other components.

Market Overview: ITAD and PVAD commonalities

ITAD stands for ‘information technology asset disposition’ whereas PVAD encompasses photovoltaic asset disposition.

Both ITAD and PVAD markets are also referred to as aftermarkets or secondary markets of the IT and solar industries. They offer alternative supply chains to buyers and sellers particularly when the market conditions of shortages, delays, and discontinued models are in flux. Increased demand for repowering causes increased supply of used assets, as higher performing assets replace older technology. Upgrades create a continuous flow of used assets into the secondary market.

ITAD and PVAD share three big similarities. Both require robust resale markets for products that aren’t yet at end-of-life. Both deal with high-value assets. And both are relationship businesses.

Resale markets for products not at end-of-life

Resale is a necessary sub-category of the overarching asset disposition umbrella. Both IT and PV assets are generally designed to last long lifespans, and a number of industry manufacturers are continuously improving upon lifespans as part of their commitment to sustainability.

“Most people think of merely recycling when they recall ‘ITAD’. The term is actually more comprehensive. It envelopes our whole [secondary] market, which includes not only recycling, but also reuse, refurbishment, decommissioning, and all other complementary services as well. It brings a larger purpose to our work, specifically to combat e-waste and recover valuable assets,” says Corey.

When an asset is decommissioned, it may or may not be at end-of-life. Therefore, proper steps should be taken to assess functionality and determine viability. If the results conclude that the product is a quality item, then it should be resold. That goes for servers and solar panels alike.

Dealing in high-value assets

Why? Because these products are high-value assets. Even as used items, they tend to retain their value. Of course, the resale price won’t be equal to the price of new technology. Still, every owner of IT/PV hardware has the opportunity to appraise their assets. This step should be included in every decommissioning project.

“Sometimes I wonder if people understand the scale of what we’re talking about,” notes Dave. “My first real experience in the ITAD marketplace was about six years ago when I worked for a large-scale resale company. My co-worker asked me to come look at some equipment that had just been delivered to the warehouse. There were three huge racks topped with two high-end Cisco Nexus switches. I’m thinking the resale value is probably around $50,000. Then my co-worker tells me that each of these racks is worth $250,000. I realized I was just seeing the tip of the iceberg.”

“We also see just a small portion of this massive market,” adds Corey. “But even what we see is bigger than we could have imagined. To give you an example, just this week our team is completing a decommissioning project of equipment with an original value of $10 million. Alta’s job is to test each asset, conduct an audit, provide data erasure, transfer certificates, and remarket the goods.”

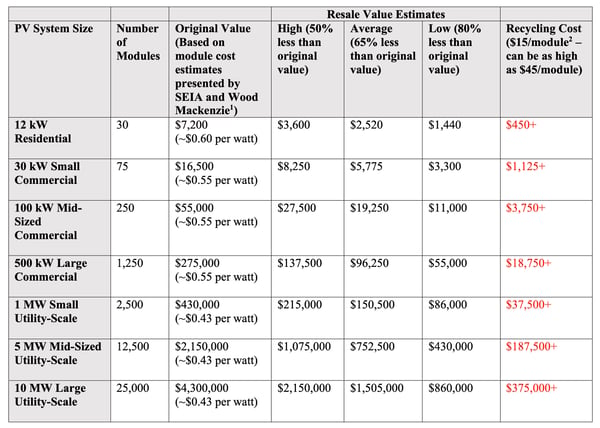

These examples illustrate just how similar in value IT and PV hardware can be. The following table suggests low-average-high scenarios for PV module resale value compared to recycling costs.

Other PV hardware components, including inverters, ESS batteries, and BOS equipment, may also have resale value. Obtaining an accurate audit of assets and potential resale value depends on a trustworthy relationship with a qualified partner.

Business based on relationships

Whether you’re dealing in IT or PV hardware, it’s a business based on relationships. The relationship begins at the first inquiry for decommissioning services and continues through the asset resale and beyond.

AltaTech and Iron Mountain are among many global corporations that are committed to product lifecycle solutions, meaning they walk with their customers all the way through a product’s end-of-life to ensure that product finishes its life at a recycling facility and not the landfill.

“We’re in the relationship business,” says Dave. “People want to work with people they trust. Customers want to be taken care of from start to finish.”

Beyond hardware trade, industry leaders excel at earning trust by caring for their customers via value-added services. Such services for a customer wanting to decommission a system may include complimentary audits, packing, transporting, and providing a quote for an equipment upgrade. These services are relevant to both IT and PV systems.

Furthermore, in a major way, PVAD spills over into ITAD, namely involving monitoring devices and data centers that store energy yield data and customer information. ITAD includes data security and erasure services, which can also be added to a solutions package for the solar customer.

Third party standards and certifications

With respect to resale, a number of resellers are questioning the importance of achieving certification from third parties. Many view such certifications as a prerequisite to earning a customer’s trust. For that reason, both AltaTech and Iron Mountain have taken the necessary steps to become R2 and ISO certified.

“We see the market headed in this direction. Other recyclers and large-scale data centers (our customers) are asking resellers to have these standards in place," explains Corey at AltaTech.

In the solar industry, Sustainable Electronics Recycling International (SERI) has expanded its R2 certification to include solar panel reuse and recycling. SERI worked with American National Standards Institute (ANSI) and stakeholders from the solar industry from 2020 through 2023 and released Appendix G in early 2024.

With ANSI’s involvement in developing R2 standards for solar panels, it’s possible that NSF/ANSI 457 will be updated in time with additional standards for the reuse of solar panels and inverters. Currently, the 2019 version covers seven categories: management of substances, preferable materials use, lifecycle assessment, energy efficiency and water use, end-of-life management and design for recycling, product packaging, and corporate responsibility. For the present time, refurbishers could voluntarily follow standards set forth by ANSI; albeit, some standards are likely more relevant to manufacturers.

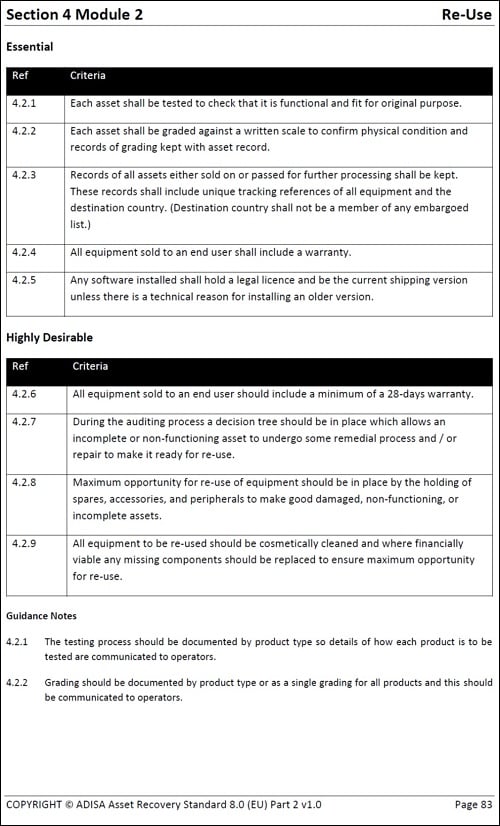

Within the IT industry, other third parties, such as ADISA, offer additional standards that solar resellers may choose to adopt today. ADISA is the global certification body behind the ICT Asset Recovery Standard 8.0, which was first released in the United Kingdom in 2021 and then made available to the EU and the rest of the world in 2022.

Section 4.2 is dedicated to reuse. These standards provide a guideline that solar resellers can develop within their companies that would not only give them an edge over competition but also enhance trust among buyers.

Additionally, ADISA standards include information on the following, which solar resellers would be astute to implement.

- Detailed audit reports should include at a minimum:

- Serial number

- Make

- Model

- Evidence of data sanitation

- Chain of custody documentation from the point of collection to the delivery into the processing center (e.g. collection notes, transfer notes, etc.)

- For recycling, provide customers with copies of certificates of destruction and any applicable waste compliance reports

- Partner with a recycling company that has all relevant environmental permits and/or licenses for their region(s) of operation. These records should include:

- Validity dates of permits/licenses held

- Verification that your partner does not export untreated waste

- Details of all incoming material movements and outgoing waste movements

- Proof that the facility has qualified personnel in place

- Keep records of all documentation on file at your facility.

“Yes, third party certifications are necessary,” asserts Dave. “You also need to plan for rigorous inspections of your partners’ facilities as well as be open to inspection by your customers. Even with third party certifications in place, we have some customers who require a level of performance that reaches beyond the scope of our certifications.”

Iron Mountain is willing to meet customer mandates as part of the company’s commitment to owning customer relationships. Any company can follow their example and strive for a high level of excellence regardless of third party certifications.

Internal processes to achieve in-house standards

When third party standards either don’t exist or fall short of delighting your customers, there are steps you can take to develop and implement in-house standards.

Start with building upon any legal regulations that exist in a given region. In the technical report, Best Practices at the End of the Photovoltaic System Performance Period published by NREL in 2021, the authors warn that some jurisdictions may prohibit the reuse of modules, inverters, and other electrical components in roof-top and building-mounted grid-tied and off-grid applications if the products do not comply with local electrical regulations.

For example, jurisdictions that have adopted Section 1509.7.2 of the International Code Council’s International Building Code require PV systems to meet the same fire rating classification as the roof. Additionally, the U.S. National Fire Protection Association’s National Electric Code Section 690.12 would prohibit the reuse of PV modules and/or inverters that are missing rapid shut-down devices.

Reselling used solar panels and inverters requires the seller to verify the safety and performance of the product. You owe it to your customers to thoroughly test every product and transparently report your findings in written documentation.

During testing, if you discover a product falls short of meeting generally accepted testing standards, such as IEEE 1547 and UL 1741, you’d be wise to include this result in your product documentation, so a buyer can accurately determine if the product is right for their system needs.

Aside from having a clear understanding of regulations, Dave and Corey recommend putting the following processes in place:

1. Develop a complimentary audit program, and complete this step for every decommissioning customer.

“I am shocked by how little details customers know about the assets they own. Even if they provide all the product data you need, double-check everything to make sure the information is correct,” says Dave.

2. Collect and store as many product details as possible. Keep electronic records.

“Product details are one key factor in determining resale value. We take into consideration volumes that our customers are historically buying. In order to do that, we need to know part numbers and what products are compatible,” remarks Corey.

3. Implement an in-house testing division and set baseline standards.

“Testing is absolutely necessary. If your company doesn’t provide testing, establish a partnership with a qualified service provider,” recommends Corey.

4. Develop a maintenance division to respond to customers’ needs as they arise.

“It’s all about owning the customer relationship. Being readily available to respond to maintenance calls is part of that ownership. If resources don’t allow for an in-house maintenance department, then find a trusted sub-contractor,” suggests Dave.

5. Put in place logistics procedures, including chain of custody documentation.

“A logistics program for the transport of high-value assets contains procedures related to packing, loading, security during transport, using third party freight services, unloading, and anything else that addresses the protection of the assets from pick-up through delivery,” says Corey.

6. Create a stamp of approval, and provide a service warranty.

“At Iron Mountain, we include our stamp of approval on all products earmarked for resale along with a unique identifier number. That way, we can readily look up an item in our database if a customer calls for service,” notes Dave.

Across secondary markets, there is no common warranty duration. For information and communications technology reuse, ADISA highly recommends a minimum of a 28-day warranty.

On EnergyBin, refurbished resellers typically include service warranties ranging from 1-5 years. A warranty program in the resale market tends to include language guaranteeing either repair of the product to a specified set of performance measures, replacement of a malfunctioning product, or a money-back clause.

Tips to excel as a resale market leader

Beyond establishing internal processes, there are additional practices your company can take to gain credibility as a reputable reseller.

Whether you’re in the ITAD or PVAD business, the following tips from Corey and Dave will aid in your success.

Corey - AltaTech:

- Be as authentic and transparent as possible.

- Regularly communicate with your customer throughout the sales process and the product’s remaining lifecycle.

- If something goes wrong, own up to it and do whatever’s in your power to remedy it.

- Act with integrity.

- Know your numbers – ratios, revenues, margins, and sell-through rates.

Dave – Iron Mountain:

- Sell customer solutions to meet and exceed customer expectations.

- Own the customer relationship.

- Be trustworthy because trust is what proves your worth in the industry.

Earning the trust of your customers takes commitment. Those who invest the time and energy into building a trustworthy business will excel as resale market leaders.

A special thanks...

To Corey Donovan at Alta Technologies and Dave Manning at Iron Mountain for sharing your resale expertise and for all you do to promote reuse as a critical element of the circular economy.

To Corey Donovan at Alta Technologies and Dave Manning at Iron Mountain for sharing your resale expertise and for all you do to promote reuse as a critical element of the circular economy.

More Resources

5 Tips to Sell Wholesale Solar Equipment Online

5 Tips to Sell Wholesale Solar Equipment Online