The second annual (2022) PV Module Price Index for the Secondary Solar Market report is now available for download.

The PV module price index tracks wholesale pricing and supply of crystalline-silicon modules that have fallen out of traditional distribution channels, and as a result are listed for resale on the EnergyBin exchange.

As a B2B wholesale solar equipment exchange comprised of 500+ member companies, EnergyBin facilitates the connection of solar companies looking to buy and sell PV hardware. Although transactions do not take place on the EnergyBin platform, sales listings documented more than 3.6 million modules (or 1.35 gigawatts) posted to the site from January 2020 through December 2022.

As a B2B wholesale solar equipment exchange comprised of 500+ member companies, EnergyBin facilitates the connection of solar companies looking to buy and sell PV hardware. Although transactions do not take place on the EnergyBin platform, sales listings documented more than 3.6 million modules (or 1.35 gigawatts) posted to the site from January 2020 through December 2022.

“Quantities for sale per listing ranged from single modules to lot sizes of 15,000+ units,” says Renee Kuehl, COO at EnergyBin. “There are a number of reasons why modules and other PV hardware flow into the secondary market. Product flows from clearance, surplus, and miscellaneous one-offs, asset liquidations from company acquisitions and bankruptcies, project leftovers, modules from cancelled or downsized projects, and used and refurbished modules as well Most of the modules - 91% - are new, but the share of used modules has increased over the years, which gives rise to new opportunities for repair and resale.”

Used, or secondhand modules represented 9% of sales listings on EnergyBin in 2022, up from 4% in 2021. The largest lot totaled 90,000 units (or 27.5 megawatts). Used prices ranged from 50-80% less than new. The upward trend in supply points to a growing number of decommissioning projects, where modules coming offline still have viable functionality. As the volume of decommissioned modules increases, so too will the opportunities for repair, remarketing, and asset recovery.

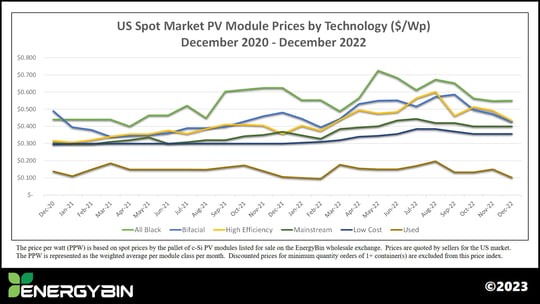

Regarding new modules for sale on the EnergyBin exchange, prices for all c-Si module classes (All Black, Bifacial, High Efficiency, Mainstream, and Low Cost) increased in 2022. However, percentage changes from January 2020 through December 2022 were minimal ranging from 0.2%-4.2% for most module classes. The exception was All Black modules, which saw an increase of 17.9%. Additionally, Bifacial and High Efficiency prices in December were pacing with EU spot prices at $0.43/Wp.

For the second year, the report findings shed light on the importance of a robust and sustainable secondary solar market to minimize waste and maximize asset recovery. Further, such a market helps with the overall adoption of solar as an affordable energy source, particularly when hardware can be sourced below national price averages. On the EnergyBin exchange, for example, in 2022, All Black modules listed as low as $0.333/Wp, Bifacial as low as $0.360/Wp, High Efficiency as low as $0.28/Wp, and Mainstream as low as $0.200/Wp.

“With the rapid growth of the global solar industry, the secondary market will also continue to grow," notes Kuehl. "Growth leads to new opportunities. In the secondary market space, we'll see these opportunities manifest in the areas of resale, reuse and repair, remanufacturing, and recycling, as well as value-added services that complement these business functions. All are necessary components of a sustainable circular economy."

Additional Resources:

A Comprehensive Guide to Wholesale Solar Equipment Brokering

A Comprehensive Guide to Wholesale Solar Equipment Brokering

The Ultimate Guide to Selling Wholesale Solar Equipment