The following article is the transcript from a conversation with Renee Kuehl, COO, and Melissa Schmid, marketing communication manager, at EnergyBin, who share insights about mid-year PV hardware trends from site activity on the B2B exchange.

Click on the video to view the interview.

Hello. Welcome to this edition of Market Watch brought to you by EnergyBin, the leading B2B exchange for solar equipment resale.

I’m Melissa Schmid, the marketing communication manager, and I’m joined by my colleague, Renee Kuehl, our chief operating officer. Renee has nearly 15 years of experience connecting wholesale buyers and sellers of IT and solar hardware. Thanks for being here, Renee.

Today, we’re discussing mid-year PV hardware trends from activity we’re observing on the EnergyBin exchange. You can access the mid-year PV Hardware Trade Analysis on our website at Resources.EnergyBin.com.

Download the PDF version of the PV Hardware Trade Analysis.

Download the PDF version of the PV Hardware Trade Analysis.

We’re half-way through 2023, and PV hardware prices, especially module prices, are finally on the decline after nearly three years of inflation caused by the coronavirus pandemic and worldwide supply chain constraints. In fact, module prices are now back to what they were in 2019.

Another factor that’s positively affecting prices is the increase in supply. First, the Biden Administration issued a 24-month tariff exemption on U.S. imports from South-East Asia. Although this exemption expires in June of 2024, it offers some stability for the present time.

Second, thanks to the Inflation Reduction Act and private investments, the domestic supply chain is expanding. In addition to growing solar panel assembly, plans are in the works for silicon ingot, wafer, and cell manufacturing. Just today, the Solar Energy Industries Association (SEIA) announced that solar and storage companies have added over $100 billion to the U.S. economy following the Inflation Reduction Act.

Regarding inverters, prices remain high due to the ongoing global shortage of semiconductor chips and insulated gate bipolar transistors (IGBTs). But the good news is that most inverter manufacturers have managed to meet demand for their products.

Renee, give us an overview of the EnergyBin exchange.

1.. What kind of companies are using EnergyBin? What are the typical categories of PV hardware products that are traded on the exchange?

Renee: EnergyBin launched in 2018 with a grant from the U.S. Department of Energy SunShot Initiative Award. The exchange is a subsidiary of Broker Exchange Network, based in Rochester, Minnesota, and founded in 2002. Although we were new to solar six years ago, we weren’t new to hardware trade. Our veteran exchange, BrokerBin, hosts more than 12,500 IT hardware wholesale traders from 65 countries.

EnergyBin’s vision came about from a desire to provide a robust and sustainable resale solution for downstream PV hardware. There are many scenarios where new and used modules, inverters, batteries, and more require a resale solution, including project leftovers, project cancellations, and design changes. Even decommissioned hardware may not be at end-of-life. EnergyBin acts as a remarketing vehicle for asset recovery.

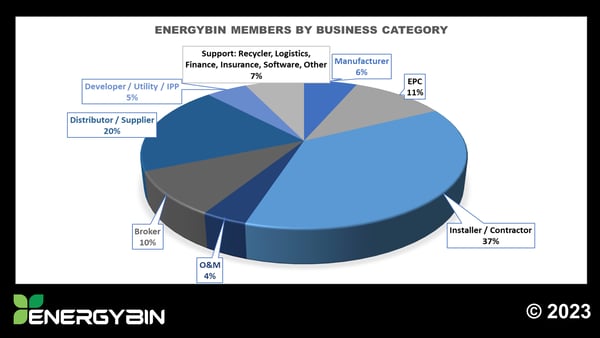

Currently, nearly 1,000 PV professionals are EnergyBin members. Their companies span from across the supply chain and include manufacturers, developers and EPCs, distributors, installers, O&M managers, utilities, brokers, resellers, recyclers, and service providers. Our membership has grown by 65 percent since January 2022, which is proof to me that more companies have a need for secondary market solutions.

Melissa: One suggestion many solar companies have heeded over these past three years is to diversify their supply chains, which helps to overcome backlogs, delays, and heightened inflation.

2. How can buyers leverage EnergyBin to locate modules, inverters, and other PV hardware components?

Renee: First of all, EnergyBin provides an alternative sourcing solution for buyers. The platform makes it easy to search for a part number.

Second, a buyer can send a Want-to-Buy request for a single part or even a full bill of materials. In a short turnaround time, that buyer will receive quotes from multiple sellers, which the buyer can review with respect to pricing and availability.

In the PV Hardware Trade Analysis, we found that 51 percent of Want-to-Buy requests are sent for the purpose of obtaining quotes. So, we know buyers are utilizing EnergyBin for its intended purpose.

Melissa: Another 29 percent of Want-to-Buy requests are sent out to locate replacement parts, especially for older models of solar panels and inverters.

3. What do you see changing in terms of technology and product availability on EnergyBin?

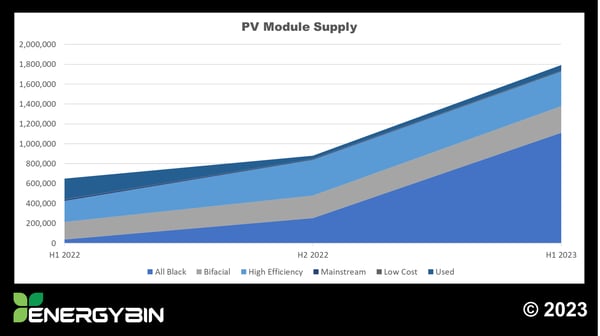

Renee: With respect to product availability, modules and inverters make up most products traded totaling 74 percent, followed by electrical and structural balance-of-system parts, and energy storage systems. In modules alone, supply has increased by 176 percent since the first half of 2022.

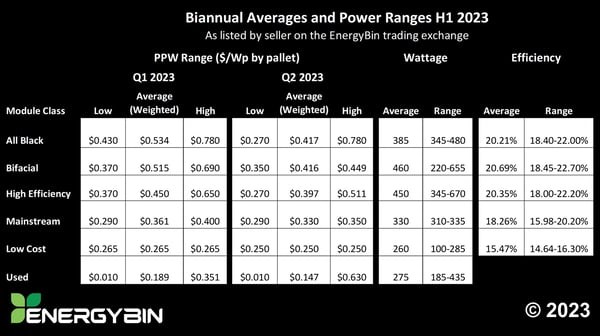

One major technological change is more efficient, more powerful modules. Our findings from the PV Hardware Trade Analysis showed that High Efficiency modules for resale on EnergyBin had an average rate of 20.35%, with the highest power module, a 670-watt panel, reaching 22.2%. These rates are tracking with U.S.-national averages for residential and commercial projects, which tells me that sellers are having success marketing high-end products on the exchange.

Even as modules become more powerful, the price per watt is declining. At the close of quarter two, the U.S. weighted average list price for high efficiency modules was 39.7 cents per watt. And we saw prices as low as 27 cents. Now, two months later, more Want-to-Sell broadcasts are coming in around 25 to 35 cents per watt. Global prices are right around 20 cents per watt.

This is all great news if you’re in the market for the latest and greatest technology. But it’s a different story if you’re looking for older technology. Take modules for example that are 100 to 300 watts and new with warranty; these are hard to come by. Some might say it’s impossible to find these products. Manufacturers no longer produce them, nor do they have reserves of these older modules in their warehouses.

On EnergyBin, these modules make up less than 10 percent of total modules listed for sale. However, the supply of used modules is increasing, which offers an alternative option for replacement purposes and low-budget projects. Several EnergyBin members specialize in secondhand solar modules, where they offer testing, inspection, and repair services, as well as limited warranties from 1 to 5 years to guarantee their products. As the secondary market grows, we’ll see more of these types of service providers entering the market.

Melissa: I’d add that EnergyBin’s PV Module Price Index, which is published annually in January, is another resource that goes deeper into module trade on the exchange. You can download the report on our website at Resources.EnergyBin.com.

Renee, you mentioned that the vast majority of products available on EnergyBin are modules and inverters.

4. What are some of the top brands named by buyers and sellers on the exchange?

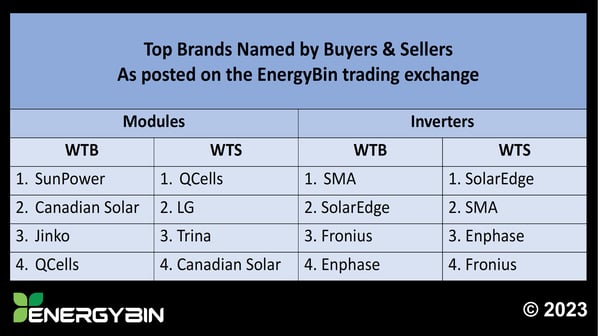

Renee: Of the sample data in the PV Hardware Trade Analysis, we discovered there isn’t a lot of difference between buyers and sellers when it comes to the top four brands for both modules and inverters.

You can see the similarities on this chart. For inverters, SMA, SolarEdge, Fronius, and Enphase are the most preferred brands by both parties.

One difference in the module category is the top requested brand by buyers, which is SunPower. These panels are hard to find, as SunPower stopped making modules in 2022. Yet, buyers want them. This trend is a resale opportunity for any broker or reseller who can find them or a like-for-like alternative module. EnergyBin makes it easy to view and respond to buyer requests like these.

Melissa: Tell us more about resale opportunities.

5. What tips do you have for solar equipment brokers and resellers?

Renee: First and foremost, log into EnergyBin daily because activity is always changing. Our traders on BrokerBin spend all day buying and selling IT hardware. They are constantly watching the exchange activity to quickly respond to buyers’ requests and not miss an opportunity to buy low. They are driven and motivated.

The same opportunities exist on EnergyBin. Remember that EnergyBin is a community of your solar industry peers. Reach out to the other members to introduce yourself. Success flows from building and nurturing relationships.

Second, reach out to our account managers – Rob and Thomas – for introductions they can make on your behalf. These two are connecting buyers and sellers every day. They’re here for you, so use them.

Melissa: Wrapping it up, I want to thank you, Renee, for your insights and keeping us up-to-date with secondary market trends.

For our viewers, if you’d like to chat one-on-one with Rob or Thomas about your solar hardware buy / sell needs, reach out to us at EnergyBin.com.

Also, subscribe to our YouTube channel to get more tips for buying and selling wholesale solar equipment.

From the entire EnergyBin team, we wish you success in your work to advance solar energy. Thank you for all you do, and thanks for watching.

More Resources

PV Hardware Trade Analysis – H1 2023

PV Hardware Trade Analysis – H1 2023

2022 PV Module Price Index

2022 PV Module Price Index